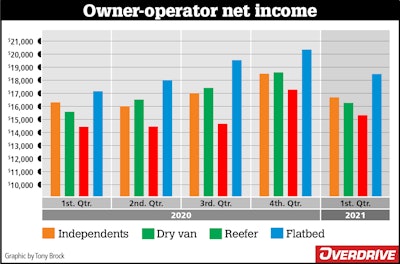

Flatbedder clients of ATBS earned more than $18,000 in net income during the first three months of 2021.Max Heine

Flatbedder clients of ATBS earned more than $18,000 in net income during the first three months of 2021.Max Heine

Owner-operators extended a financially strong 2020 into the first quarter, with net income promising a year that tops $65,000, based on ATBS client averages.

Flatbed haulers led the pack. If a March surge heralds an over-the-top construction season, their 2021 earnings might be well north of $70,000.

First quarter earnings were mostly down from the second half of 2020, but still largely higher than 2020's first half. One factor was that first-quarter miles were down, noted Todd Amen, president of ATBS, the nation’s largest owner-op financial services firm.

“Drivers are making significantly more revenue per mile in this robust market. This means they will be more choosy on loads, run less to make similar or more net," he said. "They ran more miles last year, I think, out of fear and an uncertain future. People seem more confident this is going to be a good year, so owner-operators are likely back in a normal operating mode.”

Earnings for most segments in the first quarter of 2021 declined below quarters in the second half of 2020, but were mostly ahead of first-half levels. First-quarter miles were lower than any quarter of 2020. ATBS president Todd Amen noted that following a chaotic year that ended with high freight demand, operators likely felt secure in running fewer miles in the new year.

Earnings for most segments in the first quarter of 2021 declined below quarters in the second half of 2020, but were mostly ahead of first-half levels. First-quarter miles were lower than any quarter of 2020. ATBS president Todd Amen noted that following a chaotic year that ended with high freight demand, operators likely felt secure in running fewer miles in the new year.

While that’s slightly below 2020 average annual income of $67,742, most economic indicators are showing strong prospects for this year that could take owner-op income higher. The tight trucking capacity that has been steadily pushing up rates for spot market freight and driver pay this year could easily continue if the pandemic continues to subside in the U.S.

Based on such performance and forecasts, Amen said, “I'd expect owner-operators to improve their net this year over an already great last year.”

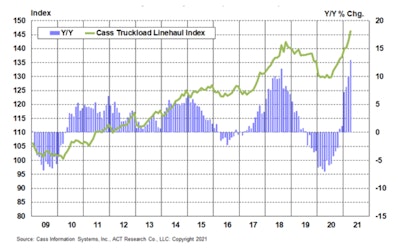

April freight data on trucking and other modes showed some record levels, reported Cass Information Systems.

“Even with considerable capacity constraints, the freight cycle is essentially in full swing as all components of the Cass indexes, with the exception of the Cass Shipments Index, posted new record highs again in April,” said Cass. “With tailwinds from a strong retail economy, a backlog of container ships still anchored in the San Pedro Bay and inventories recovering but still tight, 2021 is setting up to be an extraordinarily strong year of recovery across the U.S. freight network.”

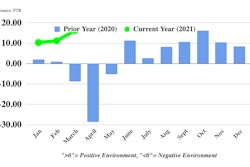

Trends extending through April show “2021 is setting up to be an extraordinarily strong year of recovery across the U.S. freight network,” says Cass Information Systems. Meanwhile, FTR’s Trucking Conditions Index hit a record level for March. It should remain high “at least through the third quarter with the possibility of one or more record readings,” said consulting firm FTR.

Trends extending through April show “2021 is setting up to be an extraordinarily strong year of recovery across the U.S. freight network,” says Cass Information Systems. Meanwhile, FTR’s Trucking Conditions Index hit a record level for March. It should remain high “at least through the third quarter with the possibility of one or more record readings,” said consulting firm FTR.

Flatbed demand came to life as miles surged from 6,175 in February to 7,712 in March. Seasonally adjusted rates for residential building permits and housing starts showed March activity well above February and year-ago rates, reported federal agencies. Other recent reports have noted rapidly rising prices on existing homes, partly because of a shortage of new housing.

Total construction spending showed only slight growth from February to March, said the U.S. Census Bureau. Non-residential demand has been dampened by shifts of office space to work from home, and brick-and-mortar retail to online shopping.

Flatbedders’ extra miles boosted net income from $5,524 in February to $7,101 in March. If their first quarter’s average net income of $18,412 holds, they are on track to earn $73,648 in 2021.

However, Amen said, “I'd expect this to slow down with the extreme inflationary costs of building materials.” With some of those costs as much as tripling, “at some point this has to slow down construction.”

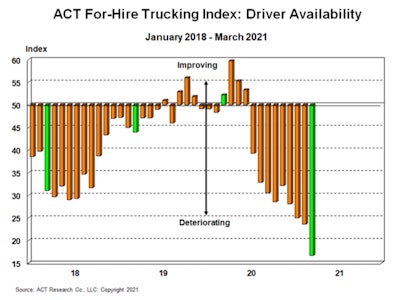

Cass Information Systems says “the record low driver availability has perhaps played an even larger role in driving freight rates to record levels recently than the truck production challenges.” Fleet executives polled by Cass cite these factors as restricting the driver pool: more retirements than new entrants, increased local trucking, stimulus payments weakening driver school attendance, the federal drug clearinghouse and “higher pay incentivizing vacation.” (Green bars represent March data.)ACT Research Co.

Cass Information Systems says “the record low driver availability has perhaps played an even larger role in driving freight rates to record levels recently than the truck production challenges.” Fleet executives polled by Cass cite these factors as restricting the driver pool: more retirements than new entrants, increased local trucking, stimulus payments weakening driver school attendance, the federal drug clearinghouse and “higher pay incentivizing vacation.” (Green bars represent March data.)ACT Research Co.

Fuel prices increased faster than miles as the year began. Fuel cost per mile rose from 38 cents in January to 43 cents in March.

“Ultimately, fuel surcharge levels the playing field on this,” Amen said. But during periods of increasing fuel prices, “it's a cash-flow drain because fuel at the pump goes up quicker than the fuel surcharges.”