There's a whole lot to chew on in today's edition of Overdrive Radio (embedded above and below for listening), chiefly comprised of a re-air the folks at owner-operator business services firm ATBS were kind enough to allow us to make of President Todd Amen's most recent semi-annual dissection of income and revenue averages, miles and more.

Don't miss an episode: Subscribe to the Overdrive Radio podcast via listening apps like Stitcher, Spotify and Apple, Google podcasts. If you get your podcasts via RSS directly into a listening app, follow this link for our primary feed.

Don't miss an episode: Subscribe to the Overdrive Radio podcast via listening apps like Stitcher, Spotify and Apple, Google podcasts. If you get your podcasts via RSS directly into a listening app, follow this link for our primary feed.

2020's lackluster beginning turned into an early-pandemic boom in March, the deepest of bottoms in April and May, then roaring back through the rest of the year and continuing to do so today for many.

[Related: No turning back: New era for direct freight]

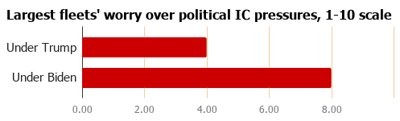

He also detailed possible headwinds particularly for leased owner-operators and their fleet partners in the Biden administration's revival of Obama-era interest in pressure against the independent contractor model for self-employed people in general. Comparing the largest fleets' responses to the question of their level of worry over the independent contractor classification issue during the Trump years and now under Biden, ATBS found the level had doubled:

ATBS also asked these large, publicly traded fleets about impacts in California prior to the stay of the state's A.B. 5 rule and just what they could do to mitigate against enforcement of it. Four options emerged: 1) Offering more choice for owner-ops when it came to load selection and other factors. 2) Requiring specific types of business set-ups (LLCs, S Corps, potentially others) to better cement business-to-business relationships in lease agreements. 3) What Amen called the "FedEx answer" given it's what that company has long done in limiting lease arrangements to multi-truck owners whose drivers are employees. And 4) In practice, Amen said, this is what most often happened: "Most fleets said you can become a company driver, get your authority and work with our brokerage, or get an address outside of California." The last of those is what he said most did.Largest fleets ATBS survey

ATBS also asked these large, publicly traded fleets about impacts in California prior to the stay of the state's A.B. 5 rule and just what they could do to mitigate against enforcement of it. Four options emerged: 1) Offering more choice for owner-ops when it came to load selection and other factors. 2) Requiring specific types of business set-ups (LLCs, S Corps, potentially others) to better cement business-to-business relationships in lease agreements. 3) What Amen called the "FedEx answer" given it's what that company has long done in limiting lease arrangements to multi-truck owners whose drivers are employees. And 4) In practice, Amen said, this is what most often happened: "Most fleets said you can become a company driver, get your authority and work with our brokerage, or get an address outside of California." The last of those is what he said most did.Largest fleets ATBS survey

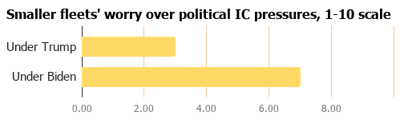

The picture wasn't much different among the smaller fleet partners of ATBS who worked with owner-operators in lease agreements.

The rate of worry more than doubled for those fleets, yet generally worry about the issues was less for smaller fleets.Smaller fleets ATBS survey

The rate of worry more than doubled for those fleets, yet generally worry about the issues was less for smaller fleets.Smaller fleets ATBS survey

It hasn't taken long at all for the Biden administration to prove that the worries were founded. As reported last week, sitting in the administration's outline of an infrastructure plan was a full-throated endorsement of the "Protecting the Right to Organize Act" the House has passed, which would nationalize the problematic ABC independent contractor test. (The B portion of the test essentially bars independent contractor status from a contractor who's fundamentally in the same line of work as the company he/she's contracting to.)

[Related: 'A shockingly good year' for owner-operator income paid off well]

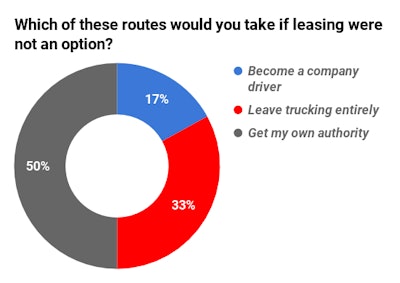

Fundamentally, though abuses of the contractor model are real in many industries, including in trucking, owner-ops are owner-ops for a reason. Few want to be company drivers. ATBS presented its leased clientele with a hypothetical. Just what would they do if faced with removal of the option of leasing to a motor carrier? Very few said they'd go work as company drivers:

More than double the number of respondents would leave trucking entirely than would become a company driver.ATBS client survey

More than double the number of respondents would leave trucking entirely than would become a company driver.ATBS client survey

The "PRO" Act, as Amen added, is unlikely to pass muster in the Senate, and as I think the above poll shows – the owner-operator's here to stay, whatever comes. Take a listen:

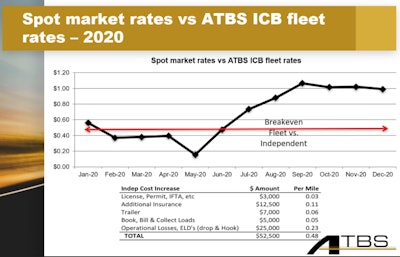

Another taste of some of the economic and income data Amen goes through in the podcast:

One reason new entrant numbers have never been higher | The cost premium for operating independently versus leasing to a motor carrier, ATBS estimates, is right at 48 cents on average -- the chart here shows where the spot rates income premium for independents on average was relative to leased income averages per mile last year. Note that as early as June we were right at what Amen noted as break-even, and it rose steeply for three months straight more than 50 cents a mile all told, and has held relatively well in spite of rises in fuel prices.

One reason new entrant numbers have never been higher | The cost premium for operating independently versus leasing to a motor carrier, ATBS estimates, is right at 48 cents on average -- the chart here shows where the spot rates income premium for independents on average was relative to leased income averages per mile last year. Note that as early as June we were right at what Amen noted as break-even, and it rose steeply for three months straight more than 50 cents a mile all told, and has held relatively well in spite of rises in fuel prices.