Trucking news and briefs for Wednesday, Nov. 22, 2023:

Diesel prices hit lowest national average since July

Fuel prices across the country have been on the decline since the beginning of November, with diesel’s national average falling 24.5 cents since the end of October. Overall, fuel prices have fallen 33.6 cents since the last weekly increase seen on Oct. 23, according to the Energy Information Administration.

With the recent declines, the U.S.’ national average for a gallon of on-highway diesel stands at $4.21 a gallon -- the lowest since the week ending July 31. Meantime, spot rates averages have held ground, with slight van declines over the recent period and gains for reefers, in high demand ahead of the Thanksgiving holiday.

Breaking the fuel price changes down by region, all regions across the U.S. saw price decreases over the last week, with the Midwest region seeing the biggest decline of 10.1 cents, followed by the Rocky Mountain region, which saw an 8.8-cent decrease.

California is the only part of the country with average fuel prices over $5/gallon, with an average of $5.64. The next-highest average can be found in the West Coast less California region at $4.57 per gallon.

The cheapest diesel can be found in the Gulf Coast region -- the only region below a $4/gallon average -- at $3.84 per gallon, followed by the Lower Atlantic region at $4.01 per gallon.

Prices in other regions, according to EIA:

- New England -- $4.46

- Central Atlantic -- $4.47

- Midwest -- $4.21

- Rocky Mountain -- $4.27

ProMiles’ diesel averages during the most recent week showed prices fall by 6.9 cents to $4.27 per gallon.

According to the ProMiles Fuel Surcharge Index, the most expensive diesel can be found in California at $5.82 per gallon, and the cheapest can be found in the Gulf Coast region at $3.89 per gallon.

Despite the recent-weeks rates gain nationally for reefers, FTR analysts with the most recent weekly rates snapshot from the Truckstop load board system pointed to considerable spot market uncertainty with fairly lackluster activity for the season.

"Total broker-posted spot rates in the Truckstop system almost always rise during the week before Thanksgiving, but that did not happen during the week ended November 17," they noted, combining the segments shown above. "Spot rates barely changed for refrigerated and flatbed." As shown, dry van declined modestly, while all three segments more typically post "rate increases during the week before Thanksgiving."

Demand metrics sat at some of their lowest levels since the late summer, meanwhile. Volume was about 17% below the same 2022 week and around 26% below the five-year average for the week. Volume was down in the Mountain Central and South Central regions but up elsewhere. Truck postings increased 4.8%, and the Truckstop/FTR Market Demand Index -- the ratio of posted loads to posted trucks -- hit the lowest level since August.

[Related: Fuel buyers' 2023 unicorn is here -- a week of falling diesel prices, rising spot rates]

Trucking conditions improved in September but market remains difficult

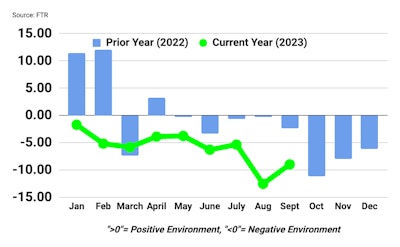

FTR's Trucking Conditions Index for September showed improvement over August, but it was still lower than the rest of the year prior to August.FTR

FTR's Trucking Conditions Index for September showed improvement over August, but it was still lower than the rest of the year prior to August.FTR

The firm noted, however, that market conditions remain quite tough for carriers, and the outlook is for consistently negative readings for the TCI into late 2024.

“The TCI was less negative in September principally because fuel costs did not rise as much as they did in August, but trucking companies saw no real improvement in freight market conditions,” he said. “Although carriers today are seeing some temporary relief due to the recent drop in diesel prices, freight rates look to improve only gradually over the next year.”

[Related: How owner-operators can avoid joining the 'capacity reduction' ranks]

Vise added that trucking “continues to struggle with more capacity than is ideal given sluggish freight volume.”

Prospects of a near-term rebound are keeping many operations around or maintaining driver levels, “but that approach amounts to an increasingly high stakes game of chicken,” Vise concluded.

[Related: Owner-op shutdown, TQL boycott: New association makes its mark]

Ambest donates $57K to St. Christopher Fund

The St. Christopher Truckers Relief Fund (SCF) recently received a large donation from truck stop and service center owners AMBEST for truck drivers in need.

The $57,387 donation, which was raised by AMBEST members and employees at the company’s 35th Annual Meeting at the Silver Legacy Resort & Casino in Reno, Nevada, on Sept 10-13, nearly doubled the amount collected at last year’s annual meeting.

“AMBEST members are dedicated to offering safe, clean and affordable places for professional truck drivers, and they pride themselves on the unique, personalized service they provide,” said Shannon Currier, Director of Philanthropy at St. Christopher. “AMBEST staff and members showed their heart for drivers through their incredible generosity at this year’s member meeting and we are thankful for their continued support.”

Since 2015, AMBEST and its members have raised over $166,000 for SCF to help truck drivers and their families who have financial needs due to current medical problems. This year’s annual meeting was attended by 401 members and guests who donated funds at the trade show and on the final evening during the Celebration Gala at the National Automobile Museum.