J.P. Transport independent owner-operator John Penn's taken comfort in spot-rates and -demand improvement reflected in the big run-up over the holidays reported in recent weeks.

Late last week he was headed back toward his Indiana home base with a spot-negotiated run picked up in California and bound for Texas. In past, loading back home after his regular LTL furniture runs outbound, after January 1 of any given year, "the rates just fell off" out of the Golden State, he said.

Not last week.

The broker he was negotiating with "put a big price on this one," he added, and a day into the run he'd already gotten a call from his principal broker back home about another Indiana-outbound run they needed his help on.

Penn hoped a "tide is turning" for freight, whether due to trucking capacity tightening with bankruptcies and/or driver exits or increased freight volumes.

Spot rates continued to show improvement for all segments over prior years, though as usual for dry van and reefer segments, rates ticked down for the first full week of 2026.

The same day Penn was speaking, FTR Transportation Intelligence hosted a 2026 kickoff for its "State of Freight" series with a presentation in which it offered other positive signals in the freight economy closing out 2025.

FTR Trucking VP Avery Vise just more than a month ago called trucking markets generally "sluggish." After the December run-up in rates exceeding holiday periods of the past couple years, though, he emphasized that pressure on foreign drivers with new out-of-service enforcement of English proficiency rules, as well as federal attention to states' non-domiciled CDL programs, could be fueling exits and tightening trucking supply.

Since June 25, when the new out-of-service ELP violations became officially available to inspectors, more than 11,000 drivers have placed OOS, and 90% of them haven't received a subsequent violation.

Since June 25, when the new out-of-service ELP violations became officially available to inspectors, more than 11,000 drivers have placed OOS, and 90% of them haven't received a subsequent violation.

[Related: Non-domiciled CDLs are back: New Jersey resumes issuance after FMCSA crackdown]

As Overdrive reported last month, Vise annualized the OOS rate to roughly 24,000 ELP OOS orders per year, if the 2025 post-OOS-change rate holds. While the figure sounds substantial, the market impact is likely limited in intensity, he guessed.

Yet other indicators around the freight economy add to the potential positives for 2026, according to FTR's forecasts:

- Utilization: Vise described a moderate tightening with upside potential: “Stronger freight could very easily yield significantly stronger utilization and stronger rates.”

- Total truck loadings: Flat for the year.

- Recovery timeline: Freight recovery expected starting mid-year, with year-over-year gains appearing by year-end.

Hope that tides continue to turn to the positive

Joining owner-operator Penn, plenty owner-operators looked out at 2026 and forecast improved income for their businesses.

More than a third (37%) felt they'd do better than 2025, another 18% predicting similar outcomes to 2025. That's roughly the same result from a similar question asked in 2024 about 2025 expectations, when positivity was higher than usual with the Trump administration incoming.

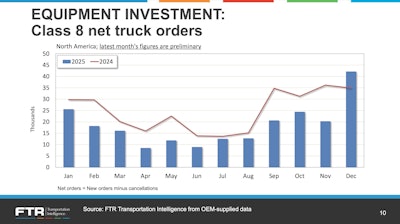

FTR analysts underscored positive outlooks with other data, pointing to the boost of Class 8 truck orders in December, reversing a year-over-year downward trend seen in previous months.

Yet Vise explained the rise is driven by two issues: clarity on tariff impacts as well as emissions regulations, as EPA pledged in November to move ahead with 2027 regs, though with some changes. “This clarity gave a green light to some of these leads,” he said, though tariffs' impact has been a barrier to orders for some owner-operators.

[Related: $9,500 tariff on a new truck? 2027 emissions regs prebuy in question]

FTR CEO Jonathan Starks cautioned the December order numbers don't signal an inflection point, as demand fundamentals remain “pretty weak.”

The analysts also offered a cautiously optimistic view for housing and durable goods markets, anticipating improvement through 2026 if interest rates continue to decline.

Conversely, industrial and equipment investment has been particularly weak. Starks called it a largely "tariff-informed environment. Either you’re pulling goods forward ahead of tariffs, or you’re utilizing inventory ahead of tariff changes.”

Manufacturing followed a similar pattern, with a rush of activity early in 2025 as businesses moved to beat tariff-related price hikes, followed by a steady deceleration; flatbed rates in 2025 moved apace.

Starks saw a disconnect between manufacturing growth and freight demand. While the computer, electronics, and pharmaceutical sectors have seen a strong upward trajectory, these high-value goods do not create sustained, high-volume freight demand.

Headwinds to positive change, Starks noted, included projection of inflation to remain elevated, though not dramatically accelerating. However, stability will depend on:

- Employment levels

- Continued tariff uncertainty

- Consumer weakness

- USMCA trade negotiations set to begin in July

Vise saw at least a slight inflection for freight markets over the last six weeks, starting around the beginning of the holiday period with Thanksgiving. He attributes it to better capacity conditions than in years past, yet cautioned FTR expects the usual seasonal decline in spot rates for both dry van and reefer segments over the next weeks. Barring a substantial weather event, that is.

Looking back over the entirety of 2025, spot rates saw slight 2% growth overall. FTR broadly forecasts 3.6% growth for 2026, which Vise characterized as a “floor based on what we’ve been seeing recently," boding well for greater improvements.

Those among readers like owner-operator John Penn, with partial reliance on spot load opportunities, no doubt hope he's right.

--Pamella de Leon contributed reporting.

[Related: Bye-bye 2025: Hope and headwinds for freight, costs, regs in focus]