California faced an uncharacteristic shortage of trucks serving its agricultural regions in January, and DAT's Dean Croke said it's because of immigration enforcement.

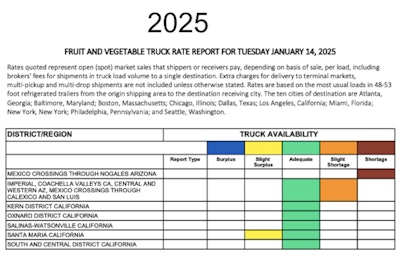

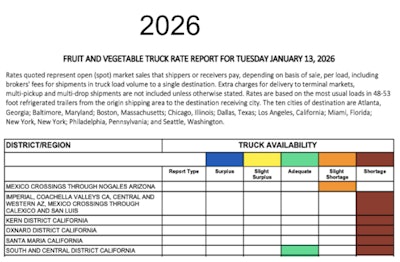

Looking at data from the U.S. Department of Agriculture's Fruit and Vegetable Truck Rate Report for January 13, Croke noticed all five of California's produce regions showing a shortage of trucks.

"It's significant this year because in a typical year, when volumes are low, the USDA usually reports an adequate supply with the exception of the Imperial Valley, which includes Yuma, aka The Winter Salad Bowl, where 90% of leafy greens are produced over winter (and where reefer capacity migrates to)," Croke told Pamella De Leon of Overdrive sister publication CCJ.

For context, here's how the report looked in the same week in 2025.

Now look at the chart from mid-January 2026. Something is definitely up, and Croke said the Trump administration's Department of Homeland Security's Immigration and Customs Enforcement changed things.

"This year, there's a shortage of trucks being reported in all regions, so a lot of carriers are avoiding the California winter vegetable market," said Croke. "Rates are always low this time of year, but the big difference this year is enforcement by ICE, DHS, et al."

California, despite being a "sanctuary state" limiting state law enforcement cooperation with federal immigration enforcement, has seen federal immigration raids within its borders.

In November and December of 2025, Border Patrol's Operation Highway Sentinel arrested 87 “illegal aliens” with commercial driver’s licenses.

Overdrive reporting on ICE activities revealed the agency "targeting drivers who are known to be illegal aliens and arresting them mostly at their homes" in states like California that don't cooperate.

The trucks that show up to haul produce in California come from all over, and crisscross the country as well. DHS made a point of saying that big interstate raids like the ones on I-40 in Oklahoma and I-94 in Indiana turned up lots of California-licensed "illegal" drivers.

DHS has also worked closely with the Department of Transportation, whose fall emergency final rule sought to sharply restrict CDL eligibility for non-citizens. The rule was paused by courts, but Overdrive reporting showed perhaps only one state in the nation is still issuing non-domiciled CDLs.

[Related: Non-domiciled CDLs are back: New Jersey resumes issuance after FMCSA crackdown]

California and DOT have clashed over non-domiciled CDLs, with the Golden State losing $160 million in federal funding after refusing to revoke about 20,000 wrongly issued CDLs for non-citizens.

California has consistently declined to enforce English language proficiency at roadside as an out-of-service violation, something President Donald Trump demanded in an executive order, and the state is alone in that regard.

More than 10,000 drivers have been placed out-of-service since June 2025, though it's unclear how many actually stopped driving.

[Related: Why state police are letting drivers placed OOS for English violations go free]

Further DOT efforts to stamp out CDL mills and ELD cheats also reflect an attitude that there are plenty of drivers around.

The shortage of trucks in California produce regions mid-January suggests that all the activity at DHS and DOT could finally move the market.

But how much? So far, national average spot rates paint a muddled picture. Spot postings, according to DAT, went down 2.3% since mid-January, but generally speaking flatbed, reefer, and dry van rates all rose from October through the holiday period. Mostly, rates have followed a usual seasonal pattern.

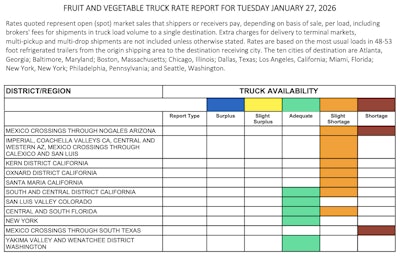

Additionally, the truck shortage spotted by Croke has eased just a bit. Below find the latest week's report from USDA and note the shortage in many ag regions has become slight.