I’ve written about avoid-like-the-plague “right of offset,” or setoff, language in contracts between carriers and partner brokers in recent months more than once. Such language allows a broker a way to do what is spelled out in the title of this post, which is itself a paraphrase of the original, not-so-sanitized way too many brokerages’ mentalities have been described to me over the years. Essentially, if a carrier agrees in a contract to give the broker the right to offset their payments for cargo claims that arise and aren’t covered by the cargo insurance, the broker is free to deduct the cost of that claim from future loads hauled, to the benefit of the customer making the claim.

Though I’ve heard more than one example lately, the outrageousness of this practice when the trucker did nothing wrong whatsoever was driven home by an owner-operator I’ve known for years, who runs nearly exclusively working with a brokerage who happens to be notorious for offset language in their contracts (we’ll call the broker T.D. Dillson here, not their actual name). Early last fall, the owner-op delivered a load of fresh fruit not exactly known for easy spoilage, and which was in his reefer for a few days on the long transit and was specified for a temperature his reefer maintained.

The receiver had some mild reservations about the fruit at the other end of the load, the owner-op recalled this week, but also took delivery, noting everything would be OK in the end. Some time later, a cargo claim arises to the tune of near $30K, which the owner-operator’s insurance company denies, working with evidence they have from the reefer unit’s download that ambient temps in the trailer were maintained as specified. Late last week, then, the broker finally, it appears, decides to pursue a course of exercising their right of offset, withholding a portion of the owner-operator’s compensation for recent loads hauled.

Keep in mind, again: neither this trucker nor his reefer did anything wrong on this particular load, delivered more than six months ago. And in fact the cargo insurance company — one of the most well-known names in the trucking business — in its denial of the claim, clearly identified the likely source of any product issues to be the shipper who put the fruit in the trailer to begin with.

Recall, too: this broker and this owner-op have until recently had a mutually beneficial, longstanding, quite active relationship with one another. Granted, near $30K is a lot of fruit, and a broker’s relationship with his/her shipper is important to keep. But is it important enough to claim you’re entitled to $30K worth of free hauling from a one-truck owner-op you’ve been doing business with, without incident otherwise, for years and years on end? Is it important enough to disregard the basic facts of the case to please a big company that wants to hold onto its money at the expense of the truth (not to mention the owner-op)?

Late last week, these were no doubt among the owner-operator and his business partner’s quite forcefully delivered arguments to the broker in question, and a President’s Day weekend and a couple days (and plenty of overheated tempers) later, the trucker’s full, not-offset check for those recent loads is on its way to the bank account, they tell.

That’s great, but that it took such strenuous effort to even occur is unconscionable, to my mind.

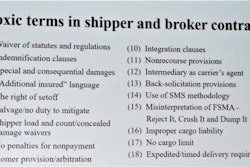

There are right now thousands of owner-ops and fleets similarly situated, under contracts that allow, if such a case arises, their businesses to be targeted to please a shipper in a similar fashion, in which case they’re “hung with what they sign,” to paraphrase attorney Henry Seaton in his past warning to carriers of all shapes and sizes about “right of offset” language in broker-carrier contracts.

Refer also back to the words of broker Eric Belk, who in a 2016 op-ed noted the abuse of right of offset clauses such as this as an issue ripe for regulatory oversight, if brokers themselves don’t do more to tamp down the practice. As I wrote last month, the broker was then (2016) preparing to remove offset/set-off language from “his company’s own standard contract (a provision he said they’d never enforced, anyway) as a way to hopefully lead by example to avoid the potential eventuality of the dreaded R word. As Belk wrote: “if we don’t become proactive with regulating this issue ourselves, chances are someone or some industry organization will attempt to influence change with new regulations that limit the use of set-off rights.”

Year 2016 was not that long ago, but long enough to say that his words fell on certainly deaf ears when it comes to brokers like the one described above. Maybe now is the time, if nothing else, for a new look at your contracts with brokers with a red pen handy for some of that fine print.