“Big trucks rule the road, they’re dangerous, and they can cause big, bad injuries.”

Those are the opening words from Atlanta-based personal injury plaintiff’s attorney Ken Nugent, standing atop a reefer trailer in a 2013 commercial. He continued: “Big trucking companies have big insurance, and I make them pay up.”

Transportation defense attorney Rob Moseley of the Smith, Moore & Leatherwood firm in Greenville, S.C., says that it’s almost like “a switch was flipped” in 2011. That year marked the advent of easy access to carrier information via the then-new Compliance, Safety, Accountability program.

With easy public access to carrier data and other tools, plaintiff’s attorneys are “better equipped than they have been in the past” and are working harder, Moseley says. “They know more about companies.”

He’s charted civil jury verdicts of more than $10 million against transportation providers, mostly trucking companies, happening more frequently, every couple months on average since 2011. Award amounts also are growing.

Trucking insurance companies, the first line of defense against civil suits for most independent owner-operators, “have been more worried about saving money than spending on lawyers” to fight a case, he says. In some ways, that’s nothing new, but fear of the gigantic award and extended case time, Moseley said, is leading to more early payouts to injured parties regardless of fault. That contributes to rising insurance premiums for carriers across the board.

Also contributing to plaintiff’s attorneys’ arguments for higher awards are escalating health care costs and “a paradigm shift, too, where jurors walk in thinking it’s Monopoly money,” Moseley says. “They’ve been conditioned through media to not really understand what a million dollars is.”

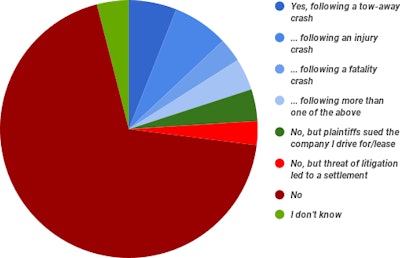

In spring polling, one in every five of Overdrive’s mostly owner-operator readers reported being named directly as a defendant in a civil trial following a crash.

Have you been a defendant in a post-crash civil lawsuit?

There’s plenty for owner-operators, especially independents, to learn from bigger carriers who’ve been targeted in questionable litigation. Making smart choices about where to spend your money to ward off risk could be key to your survival if you collide with a four-wheeler.

Excess liability insurance

The threat of litigation is ever-present in the event of an injury or fatality accident, said Bill Strimbu, president of Nick Strimbu Inc., a third-generation 130-truck flatbed, refrigerated and specialized carrier. And that even goes for accidents where you might not expect litigation to rear its head.

Strimbu say one of his trucks left the roadway and flipped in a ditch three years ago. “The woman who later said she was following the truck claimed she was so scared, she hit her brakes” and came to a quick halt, injuring her neck.

She brought her chiropractor along to negotiations, Strimbu said, though “I didn’t want to settle out of court where we weren’t at fault.” That’s a common complaint of carriers threatened with litigation and advised by insurers and their representing attorneys to seek a settlement.

Strimbu fought the allegation, and the lawsuit was withdrawn. “But the statute of limitations is not up yet,” Strimbu said. “She can refile if she can find another blood-sucking trial lawyer to take the case.”

The company carries an extra $1 million in excess liability insurance over a standard $1 million policy, but with a high deductible of $100,000 to reduce the premium’s expense. That means he’s responsible for any insurance settlement in a given year that’s under $100,000.

It’s notable that in the few cases he’s been to court over during the last 10 years, they ended up costing $2 million and $2.5 million, right at and above the limits of his liability insurance. “They would have been more had we had more insurance coverage,” Strimbu said.

Therein lies the paradox around what’s been the traditional line of protection against civil liability litigation – liability insurance. It seems wise to have as much protection as you can afford. Yet the more you have, as the example of Strimbu’s court cases suggest, the more likely it is that an abnormally high post-jury award will ultimately result in a settlement near or equal to the limits of whatever you carry, increasing costs for you and your insurer.

Given these dynamics and the minimum $750,000 in government-mandated required liability coverage, it’s no wonder trucking businesses become a target for plaintiff’s attorneys.

“There’s a lot of states where claimants get attorneys, and even if the claimant is at fault, if they can demonstrate comparative negligence” – shared fault by both parties – and “show that a trucker was at least 50 percent at fault, their claimant might not have to pay anything,” said Steven Libertore of insurance agent National Risk Management Services. “It doesn’t hurt that [claimants] get letters from attorneys saying, ‘You don’t owe us a dime unless we get money for you.’ ”

Libertore added that for the smallest fleets with which he specializes – one to nine trucks – insurance policies typically have no deductible. In other words, the small fleet pays no part of any claim directly.

Insurers, thus, for the majority of those smallest fleets, are even more inclined to settle if they have a sense that a drawn-out court case could go awry toward a high award.

For a motor carrier large or small, it “comes to that question,” said Strimbu: “How much do you really need? You can only afford so much, but if it was cheap enough, I’d have $10 million.”

Excess liability insurance is at least cheaper than the primary policy for an owner-operator with his own authority, said Libertore. While the first million in coverage could run from $5,000 to $10,000 or more in annual premiums, “you’re looking at $1,250 to $1,500 for that extra layer of a million,” he said.

The good news is, in the case of Libertore’s clients, “it’s been a very long time since we’ve had a small fleet [one to nine trucks] that gets into the six-figure mark” with a settlement.

Huge jury awards in civil trials

Defense attorney Moseley has compiled some of the largest jury awards since 2011, when the CSA program made it easier to access carrier information. As says Risk Manager Josh Fulmer, of the Carroll Fulmer Logistics trucking company, cases that go to trial can drag on for seven years or more before a single dime reaches the injured party. The following are based on press reports that emerged in the wake of selected trials and/or appeals.

2013: $178 million. This verdict, decided in California against Bhandal Bros. Trucking and its driver, would have been the largest wrongful death verdict in California history had it not been successfully appealed. The truck’s driver was parked on the shoulder of I-210 in Los Angeles County when it was struck as an automobile pulling a trailer veered off the highway and plowed into him. The accident scene was particularly horrific, with two parents and one child dying while trapped in the vehicle as a fire broke out and two surviving children looked on. The initial jury award of $178 million was later vacated in total, and the parties ended up settling out of court for an undisclosed sum, according to reports.

2013: $281 million. Oilfield services company Heckmann Water Resources was on the receiving end of this judgment, handed down after a Heckmann truck lost its driveshaft near the Eagle Ford Shale area in Texas. The part came through the windshield of Carlos Aguilar’s pickup and killed him. The lawsuit relied on an argument of improper maintenance of the truck after both the company and driver were cleared of criminal wrongdoing. In 2014, Heckmann appealed, then settled out of court.

2015: $165 million. The family – a deceased mother, her deceased daughter and severely injured son – was awarded this amount in what was called the largest civil suit award in New Mexico history. The plaintiffs’ pickup, parked on the side of the road, was struck by a FedEx Freight truck. At issue in the initial trial and unsuccessful attempt to garner a new trial were plaintiffs’ attacks aimed against the company’s use of contractors for its freight movement. Also at issue were specifics of the truck driver’s medical history. At the time of the retrial, FedEx was expected to pursue an appeal, according to reports.

More in this series:

**Cameras and ELD evidence

**Stay on top of your driving data

**A primary tool in wading off post-crash litigation threats