Previously in this series: ELDs’ final shift: How poor customer service can cause noncompliance

In addition to the approaching ELD deadline, a major factor influencing recent trucking technology decisions is the sunsetting of 3G CDMA cellular networks. Many fleets have been running AOBRDs with soon-to-be-outdated 3G technology to keep their offices connected to drivers and various mobile applications.

As the ELD deadline approaches, owner-operators and drivers with such fleets are likely to see not only changes in logging procedures but also hardware upgrades or wholesale provider changes. As for independent owner-operators and small fleets using ELD hardware dependent on 3G networks, Ken Evans, chief executive for ELD provider Konexial, believes many probably aren’t “even aware of the 3G sunsetting issue. If they were, then there would be a lot more market activity than there currently is. Most carriers will be in for a rude awakening when the 3G network dies or they cannot get 4G LTE hardware at the last minute.”

Konexial’s ELD platform, My20 Fleet, integrates with its GoLoad dynamic load matching service for its customers to receive load opportunities directly from shippers based on their location, hours of service and asking rates.

Even though the software on most AOBRD devices with 3G cellular modems can be updated over-the-air to be ELD-compliant, owner-operators and fleets have to consider whether they want to keep using their existing hardware.

“Eventually [3G coverage] will be a problem,” said Eric Witty, a vice president for Trimble Transportation Mobility.

The U.S. market will be the first to experience a degradation in 3G service, while in Canada and Mexico, 3G is “going to probably be around longer,” said Flo Dougherty of Omnitracs.

Verizon, AT&T, Sprint and T-Mobile all have announced they will be shutting down 3G service in the United States over the next couple of years. The companies will shift resources to expand 4G LTE and build out next-generation 5G networks.

Verizon will be the first to shut down its 3G network, completing it this year, just in time for the ELD mandate’s final Dec. 17 deadline. The timetable is less certain for other wireless networks, but they can’t afford to lag too far behind, and the impending change already is influencing the mobile strategies of motor carriers.

Learn more about your ELD options

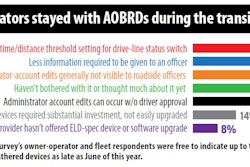

One of the most important dates for your fleet is December 17, 2019, when all carriers must use technology that meets the new ELD requirements. When Overdrive and CCJ surveyed fleets and independent owner-operators with authority in June, almost half of respondents in the 100-plus truck fleet group reported they were continuing to use AOBRDs.

When you click to download this guide, you’ll find out information on:

- Device types

- Initial and ongoing costs

- Capabilities of each device

As one of the largest players in the fleet market, Omnitracs had been selling a 3G-enabled IVG mobile platform until the end of 2018. Prior to IVG, the company sold an in-cab MCP platform. Both systems used 3G from Sprint or AT&T. Since the start of 2019, all of Omnitracs’ products are 4G LTE-enabled.

As a migration path to 4G, the company is rolling out the Omnitracs One platform that can run on tablets, smartphones and in-cab IVG devices. Customers can choose their own cellular network or have Omnitracs manage it for them.

Truckload carrier Schneider has some 3G devices – the Omnitracs MCP200 platform – in its fleet, and “we are going to use them until they don’t work,” said Mike Degeneffe, a Schneider vice president. Since early 2018, Schneider has been running 4G LTE tablets.

“We do a lot more than the hours of service on our tablets,” said Mike Degeneffe, Schneider’s vice president of IT solution delivery. “The tablet is an extension of our back office.” Software on the tablets for hours recording is by the Platform Science company. The tablets’ Android platform should position the Green Bay, Wisconsin-based carrier well for the 3G network’s sunset starting this year.

“We do a lot more than the hours of service on our tablets,” said Mike Degeneffe, Schneider’s vice president of IT solution delivery. “The tablet is an extension of our back office.” Software on the tablets for hours recording is by the Platform Science company. The tablets’ Android platform should position the Green Bay, Wisconsin-based carrier well for the 3G network’s sunset starting this year.One advantage of using a consumer tablet device is that as 4G changes to 5G, Schneider does not have to worry about having outdated hardware that is exposed to network service disruptions. This is because the shelf life of tablets is so short that replacing and upgrading them will be a necessity before 4G networks become obsolete.

For former driver and current safety director Doug Fry, who works for a fleet with terminals in Texas and Georgia, outdated 3G hardware in part influenced a decision to switch to a new e-logs provider this year, one with an easily expandable architecture.

Of the old system his fleet was using, Fry said, the onboard computers tethered to the truck’s ECM were “going obsolete, as better than 90% of the ones we had purchased and installed were not 4G LTE devices, and the shutdown of the older CDMA networks was going to leave enormous gaps in coverage where the vehicle would be unable to communicate. Even with volume discounts from our provider, we were still looking at nearly $1,000 worth [per truck] of new ELD equipment.”

For a 200-truck fleet, he adds, “that’s a heck of a hit to the bottom line.” –Todd Dills contributed to this report