Previously in this series: Hopes and hazards in using ELD data: Detention reduction

Truckstop.com plans to use ELD hours data as a way to help put load offers in front of carriers that have drivers who not only are close to the load but also have sufficient on-duty hours, says Brent Hutto, chief relationship officer.

“Because the broker doesn’t want to be liable for the hours of service” information, he says, third parties such as Truckstop.com can be the facilitator of such data, employed in a “predictive algorithm that will propose the best freight to the carrier.”

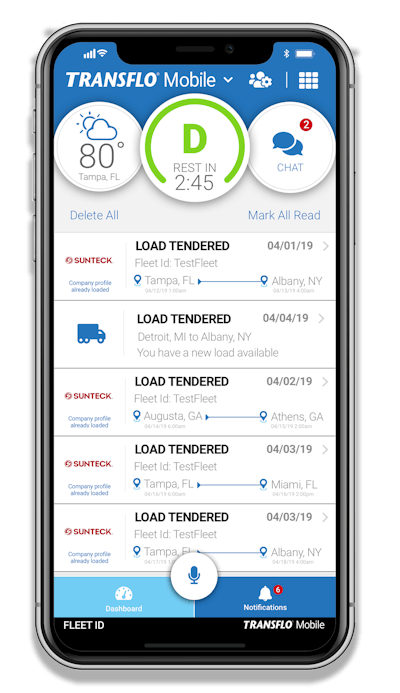

Though Transflo uses ELD data to build out its suite of services, centralized mostly within its Transflo Mobile app, ELD data also has enabled tools that make it easy to share detention information with shippers toward improvement, says Doug Schrier, a Transflo vice president.

Though Transflo uses ELD data to build out its suite of services, centralized mostly within its Transflo Mobile app, ELD data also has enabled tools that make it easy to share detention information with shippers toward improvement, says Doug Schrier, a Transflo vice president.KeepTruckin, which is introducing a load board later this year, also is planning to bring ELD-derived hours and location data to bear in matching carriers with loads from brokers and shippers, says Shoaib Makani, chief executive officer.

The technology platform from FleetOps that underlies BigRoad Freight already is doing this to an extent on a smaller scale. ELD provider Konexial offers the GoLoad matching service in partnership with a shipper software provider.

Tracking-technology companies such as Trucker Tools and Macropoint likewise have built freight platforms and ELD-provider integrations that have some similar predictive-type capabilities, as reported in Part 1 of this series. They’re all promising better utilization of trucks, with less time spent planning and negotiating individual loads.

Truckstop.com, which requires customer consent for use of its data, has long aggregated anonymized truckload rates data from its load board, transportation management software providers and other partners. It then serves it back to customers and the general public through media and their own users’ software as market indicators, Hutto says.

Two ELD providers with whom Truckstop.com is building a data connection for carrier customers are KeepTruckin and BigRoad. “In technology, you can be competing with and cooperating with the same entity” at the same time, Hutto says. That includes KT’s own load board, planned for release this year, and long-extant BigRoad Freight.

To an extent, you could say the same of independent owner-operators and small fleets working with both brokers and their shipper customers. Yet most aren’t in the same position regarding brokers’ customers. Back-solicitation prohibitions, effectively noncompete clauses, in broker-carrier contracts are written to prevent carriers’ contacts with shippers from leading to active carrier solicitation of that shipper’s direct business.

As Jon Gavrilyuk of Safe Way Carrier explains, “As a carrier, we can’t go to a customer and say, ‘Screw the broker’ ” and do business directly with the carrier, which is a breach of contract. Though adherence to such clauses isn’t universal, plenty of carriers honor their contracts, Safe Way included, Gavrilyuk adds.