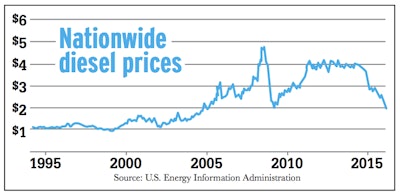

When diesel dipped below $1 a gallon in late 1998, it was big news, even though the change was slight. Diesel prices continued to make news as they began an erratic, relentless climb to almost $5 in 2008.

By then, the impact wasn’t as great as it could have been due to the growing use of fuel surcharges in shippers’ contracts with large carriers, and increasingly with smaller ones, too. Now that surcharges are even more entrenched, the plunge to below $2 a gallon after about three years in the $4 range has generated relatively little notice among owner-operators leased to carriers big enough to command a surcharge.

Fuel surcharges have largely gutted the downside impacts of diesel price volatility, but not for all operators.

Fuel surcharges have largely gutted the downside impacts of diesel price volatility, but not for all operators.Senior Editor Todd Dills, in a recent blog, notes a few operators who have seen their surcharge windfall dwindle. Consider an operator averaging 8 miles per gallon and receiving a surcharge pegged to 6 mpg. The higher fuel costs go, the more he gets back as compensation for fuel.

“We have certainly heard from a few that are missing the higher cost of fuel for this reason,” says Todd Amen, president and CEO of ATBS, the nation’s largest owner-operator financial services firm. Also, “The fuel surcharge adjusts a week in arrears, so drivers benefit from a higher fuel surcharge the prior week as they wait for the adjustment.”

The flip side is that when fuel prices eventually rise, especially if it’s at a fast clip, owner-operators could get the short end of the stick.

One other cash flow issue has worked in the favor of some owner-operators now that prices are so low, Amen notes. “A driver may have been only able to fill up half the tank because it was so expensive, so he was forced to stop more often. Now he can fuel up and run.”

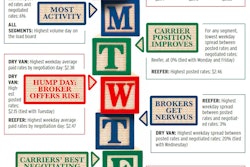

These are not make-or-break matters for owner-operators. Changes in fuel prices carry more import for those operating on the spot market. Rates resulting from broker negotiations there are volatile enough load to load, even when you don’t directly account for the rise and fall of fuel prices, and more complex when you do.

As our Tomorrow’s Trucker series that will appear in the March issue makes clear, successful owner-operators are increasingly tapping into real-time data. In the case of spot market rates, for example, DAT and Truckstop.com, among other sources, can provide the kind of insight that helps you make tough calls on loads.

Yes, it’s extra work, but it beats the extra work of driving too far for too little money.

How has cheap diesel affected your business?