Trucking analysts have been saying roughly the same thing for the last year: The 2018 boom is history, but doomsday is not at hand. Freight demand, like the economy, is lackluster. A recession might be around the corner … or maybe not.

Steel production is one area of the economy ending the year on a weak note.

Steel production is one area of the economy ending the year on a weak note.This mantra surfaced repeatedly in its more pessimistic form during 2019 with news of fleet closures, climaxing with Celadon’s sudden collapse. Its size – operating more than 3,300 trucks and tractors – made its demise notable, but its financial troubles well predated the good times of 2018. That particular closure adds little support to a gloomy outlook for trucking.

Looking more broadly at fleet closures, Broughton Capital LLC counts 640 fleets that had closed through the first nine months of 2019, more than twice the 310 carriers that closed in all of 2018. “It looks like a dramatic jump, and indeed it is, but it’s off an extraordinary all-time low,” said BC’s Donald Broughton in an interview with my colleague Tom Quimby in November.

Other points to be made on the glass-half-full side: Unemployment was still at record lows as the year ended. Major stock markets hit all-time highs in December. The U.S.-Mexico-Canada trade agreement is expected to at least prevent the economic hit that would have accompanied President Trump’s planned withdrawal from NAFTA. Among industries expected to gain are some of trucking’s favorites: auto production, agriculture, manufacturing, mining and energy.

On the glass-half-empty side: Trump’s trade negotiations with China seem to have threatened economic stability more than encouraged it. Other uncertainties, such as those surrounding the November elections and the Trump impeachment initiative, tend to inhibit economic growth and confidence.

Also, some trucking indicators pointed in the wrong direction. North American Class 8 truck orders in November were 17,300, down 21% from October and the lowest November total since 2015, according to a preliminary report from consulting firm FTR.

Spot rates, sensitive to current market demand, have dropped 15% to 25% below contract rates, Broughton said in a Dec. 17 webinar. He also cited declining trends in steel production, chemical shipments, residential construction and automotive sales.

These developments are largely out of owner-operators’ control, notes Todd Amen, head of financial services provider ATBS. “The best advice is to prepare for the downside,” he says. “The upside will take care of itself.”

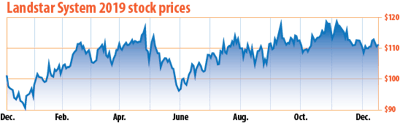

After a notable decline in May, the stock price of Landstar Systems, the largest all-owner-operator fleet, reflected continuing investor confidence in the owner-operator market from June at least through mid-December.

After a notable decline in May, the stock price of Landstar Systems, the largest all-owner-operator fleet, reflected continuing investor confidence in the owner-operator market from June at least through mid-December.Part of that downside prep is ensuring your finances are in order. Whether the next notable downturn comes this year or later, for starters, do what you can to start paring down any significant debt.

“I’d plan for a 2019-like year,” Amen advises. “Control costs, don’t be picky on freight, generate revenue, and cover fixed costs.”