PARTNERS IN BUSINESS TABLE OF CONTENTS »

Take time to prepare for this big step

As an owner-operator, you enjoy more freedom from supervision than a company driver. As an owner-operator leased to a carrier, to an extent you’re able to set your own hours and take time off when you want. But those freedoms come with a big tradeoff: being financially responsible and self-disciplined. The challenge is great, but the rewards can be, too.

Why do you want to be an owner-operator? If your answer is to work hard, make more money and have a more rewarding life, you have a good chance at success. The successful owner-operator is driven above all else by the prospect of financial payback for time and investment.

There’s reason to believe it’s a good time to pursue this dream, and that’s not based just on economists spouting rosy forecasts. It’s also based on the track record of the last couple of years.

Though anemic demand marked 2015 and 2016, things picked up noticeably in 2017. 2018 started out reasonably well, fueling hope that strong owner-operator prospects might continue through 2019.

According to owner-operator business service provider ATBS, overall owner-operator net income averages have risen to the highest levels the organization has seen since it began tracking the averages 13 years ago. Unless the economy hits a bona fide recession, income increases are likely to continue.

For owner-operators, another clear plus is the availability of money to finance equipment. If you’ve been hamstrung since the 2008-10 recession with marginal credit and a truck in need of trading, or if you’ve been unable to move into a truck for the first time for these reasons, this should be good news.

QUALITIES OF SUCCESS

Most drivers who become owner-operators already know about the need to run a lot of miles while driving safely and legally, but other qualities also are important.

RESPONSIBILITY. Develop your own business systems, and set up a regular truck maintenance program. Plan for the hard times when your business is good. Set specific goals.

RELIABILITY. Good customer service is vital to your success. Being dependable means you’ll get the loads you need to get the revenue you want.

MOTIVATION. Without the desire to earn money, the freedom of being an owner-operator won’t amount to much when the truck payment is due. This means being available to carry the loads and being smart in choosing profitable loads.

WILLINGNESS TO LEARN. Seek knowledge. Ask questions. Know your limits, and learn to overcome them.

MECHANICAL APTITUDE. You may not have to do major work on your truck, but every dollar you save by doing simple tasks yourself goes straight to your bottom line.

SELECTING A BUSINESS SERVICES PROVIDER

The most successful owner-operators start modestly and manage well. Until you learn the ropes of owning your business, focus on managing both business and personal expenses. Along the way, you’ll be responsible for a lot, such as accounting, taxes, financial goals and your own rules of conduct. A strong financial services provider can provide this assistance and guidance.

Over the long term, the ability to tie the financial side of the business seamlessly into the systems of freight partners could make it easier for independent contractors of all stripes to manage the day to day of their businesses.

Many owner-operators fail within the first few years, as do most small businesses. A good services provider often can save you an amount of money that more than covers the annual service fee.

Such a provider should be able to give you all the tools necessary for running a profitable trucking business. These include:

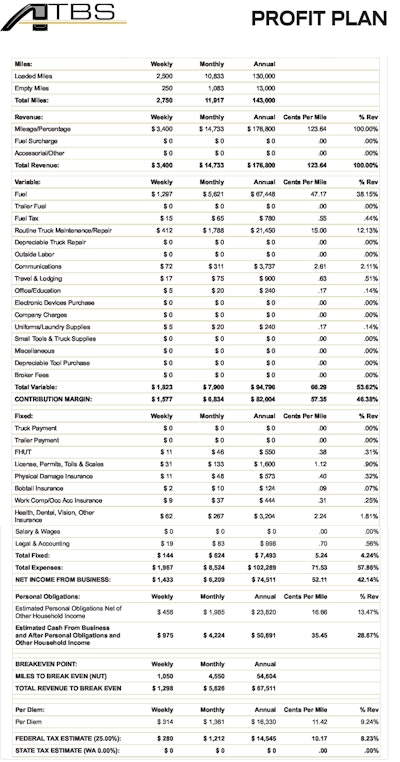

PROFIT PLANNING. A profit plan is akin to a budget, or a plan that helps you oversee your business and control your future, including both business and personal expenses and goals.

BOOKKEEPING. Sorting and tallying receipts and settlements can take several hours a week. A good business service can, in effect, give you back that time.

PROFIT-AND-LOSS STATEMENTS. These tools provide snapshots of your business’ health. A profit-and-loss statement shows your revenue, fixed and variable costs, net income, contribution margin and break-even miles.

BENCHMARKING. This is the practice of comparing your business to the rest of the industry to decide what changes may be needed to maximize your profitability.

TAX PREPARATION. Many federal and state income tax rules relative to trucking are complex and constantly changing.

You need a business services provider with tax expertise in trucking – one that has a Certified Public Accountant and Registered Tax Return Preparers.

This critical expertise helps professional drivers find every legal tax deduction, thereby helping to reduce your tax burden significantly.

A good service provider also will support you in the event of an audit.

RECEIPT ARCHIVE. A good provider will house receipts and financial documents in a place where you can access them anytime on the road or at home. This information should be in an encrypted secure site that keeps your personal information safe.

BUSINESS CONSULTING. A good business service provides continual support through business consulting to help you better understand the essential tools of business and use them effectively.

FINDING THE RIGHT MATCH

Choosing a business services provider is an important step that should be taken carefully. Consider these criteria to make your choice:

- How long has the provider been in business and serving the trucking industry?

- Does the provider understand how the trucking industry operates and where it’s headed?

- Is the company large enough to provide the best services, benchmarking and comparison data?

- Is the provider’s customer base composed of successful owner-operators and fleets?

- Does the tax staff hold professional tax credentials and have trucking-specific expertise?

- Do the provider and its tax department provide audit support by CPAs or enrolled agents if a client is audited?

- Does the provider offer an assigned consultant, or do you typically speak with a different person every time you call?

- How does the provider charge?

Work with your business services provider to determine key issues to address in your operation.

Based on this information, your consultant should help you complete your profit plan and fill in any missing information.

Once completed, your plan will help you manage expenses so you can run a successful operation. It will allow you to make any necessary changes to your business on a monthly basis instead of at tax time, when it’s often too late.

HOW TO DETERMINE YOUR NET WORTH

Profit planning can help you be financially secure when you retire. Take time to build balance sheets to calculate your net worth. The balance sheet compares your assets with your liabilities.

Start with what your business owns: Write down how much money is in your business checking and savings accounts, and don’t forget escrows or maintenance reserves your carrier may be deducting from your settlement fund. Next, determine how much your equipment is worth.

Next are your business liabilities: your truck or trailer loans, business credit card balances, outstanding accounts with vendors and repair shops, etc. Subtract your liabilities from your assets, and you have the net worth of your business. If it’s positive, it becomes an asset on your personal balance sheet. If it’s negative, then it’s a liability.

Do the same for your personal balance sheet. The difference between your assets and liabilities is your net worth.

CREATING YOUR FINANCIAL MAP

Under this plan, the owner-operator runs 130,000 loaded miles, earning $74,511 on $176,800 in revenue.

Under this plan, the owner-operator runs 130,000 loaded miles, earning $74,511 on $176,800 in revenue.A business plan, also known as a profit plan, is one of the most effective business tools you’ll use as an owner-operator. Think of it as a road map that allows you to track income and expenses over time, with the goal of reaching your desired financial rewards. A business plan helps you make ends meet. It shows you exactly how much money is needed for expenses, where it will be spent and how much you can afford to pay yourself.

Your business plan should show all sources of income and costs while taking into account industry averages, personal expenses and cash flow. It also should provide this complete financial picture in weekly, monthly and annual detail.

It also allows you to know when you have reached your break-even point – after which every extra mile driven puts more money in your pocket.

GETTING STARTED

The best time to begin the planning process is before you start your business. The process will give you targets, and these can be compared later with your actual financial performance to see where adjustments are needed to maximize profits.

In its simplest form, the business or profit plan should identify your revenue — or gross income — and your expenses. All personal household expenses should be included. While your books may reflect a profitable business operation, you may fall short of your personal needs and desires if household expenses are left out.

BE REALISTIC

As you work through this process, gather as many of your collected invoices or settlement statements, bills and receipts as possible. Accumulate three to four months of expenses to reflect your spending habits properly. Don’t forget to budget for savings, estimated taxes, unexpected situations and lean times.

If you lack past data for developing your plan, be conservative in estimating your income, and slightly overestimate your expected expenses so you don’t start out with a flawed plan. If there is money left over, place it into savings for emergencies.

If you need help, a business services provider such as ATBS can estimate costs you may not be sure of.

Download the entire Partners in Business Manual

Chapter 1: Becoming your own boss

Chapter 2: Bookkeeping and business analysis

Chapter 3: Understanding your revenue and costs

Chapter 5: Controlling fuel costs

Chapter 6: Controlling tire costs

Chapter 8: Income tax and other taxes

Chapter 9: Choosing a business structure

Chapter 10: Truck buying, leasing, financing

Chapter 11: Choosing a trailer

Chapter 12: Maintaining your equipment

Chapter 13: Choosing a carrier

Chapter 14: Computers, mobile devices and the internet

Chapter 15: Staying compliant and safe

Chapter 16: Trucking insurance

Chapter 17: Health and income insurance

Chapter 19: Saving for yourself