The first week of the new year “has broken all the records we set when we ended the old year,” says DAT’s Matt Sullivan, referring to the weekly charts and graphs of spot market data Sullivan shares with Overdrive. “Load-to-truck ratios and national average rates spiked big time.” A lot of it, he adds, can be attributed to weather, on top of constraints in the wake of the ELD mandate.

Operator vacations, or willfully extended downtime in protest of the mandate, as it were, could have had an effect as well. As of Wednesday, Jan. 10, around midday, about 14 percent of respondents to this week’s poll question reported having shut down in protest or left the trucking business as a result of the mandate. (More than twice that, for what it’s worth, reported having changed nothing at all as yet due to the mandate — either being exempt or remaining on paper.)

For those back from a holiday break and/or otherwise dealing with the post-mandate reality, high demand like as not was the norm, as DAT’s numbers show. On the road, anecdotes of $5/mile and higher load offers weren’t hard to come by. Owner-operator Mark Kirbyson told the tales of loads he’d heard about: a Toronto to Houston roundtrip offered at $16,000-plus, $12K one-way from Colorado to Poughkeepsie, N.Y., $6K from Albany to Chicago.

His business, operating as a private carrier for a Canadian chicken processing plant delivering in the U.S., taking bananas for-hire back out often as not, had seen some rate increases as well. Running newly on an ELD and seeing firsthand special-case constraints in the congested Northeast, he at the same time looks at the heat building on rates in the market and asks expansive questions about the full context of it all: How long can the upward pressure last before it hits the most vulnerable in the population, and all of us, really, with consumer cost increases?

“Nobody really wants to get into this factor” given the offset higher rates provide for new constraints, he says, but “when the cost of everything rises, who has to bear that burden? The people who couldn’t afford to live before,” that’s who, “and Lord knows the government can’t afford to take care of them. I do care about those little kids that can’t eat tomorrow or go to school because they can’t afford it, those seniors who can’t afford to eat.”

How long market temps continue to rise remains to be seen, but rise they have, for certain.

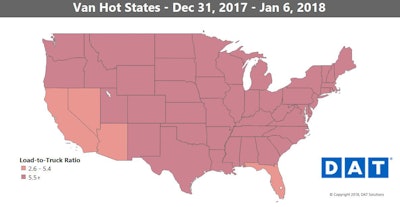

The national average van rate hit 2.30/mile on January 6. That’s a new record high, breaking the one that was set just a week prior, and rates on a majority of the top 100 van lanes continued to climb last week.

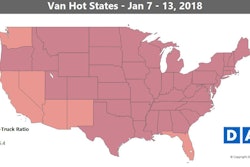

The national average van rate hit 2.30/mile on January 6. That’s a new record high, breaking the one that was set just a week prior, and rates on a majority of the top 100 van lanes continued to climb last week.For vans, there were also the first signs of some trends moderating recent intensifying of demand and upward pressure on rates. More on that in a bit.

Hot markets: Deep snow also made it more difficult for trucks to operate on the lane from Buffalo, N.Y., to Allentown, Pa., which pushed the average rate up 41 cents to $4.22 per mile. Not all rising rates were weather- related, though. Houston was the top market for rising volumes, and outbound rates were up 6 percent on average. Denver typically trends in the opposite direction of California, and California rates are down, so Denver was up last week.

Not so hot: As for those moderating trends, outbound rates were down 4 percent in both Dallas and Los Angeles. And of the lanes that had lower rates last week, there were many more with significant declines than we had been seeing in recent weeks. For example, Columbus, Ohio, to Allentown fell 36 cents, but still averaged $3.78 per mile. Of course, winter storms could change all of this.

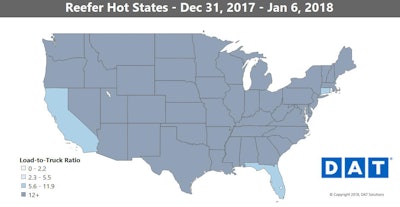

The demand for refrigerated trailers peaked at year-end, but the extra-cold weather in many parts of the country has kept rates at all-time highs in many areas, since those trailers are being used to keep freight from freezing.

The demand for refrigerated trailers peaked at year-end, but the extra-cold weather in many parts of the country has kept rates at all-time highs in many areas, since those trailers are being used to keep freight from freezing.Reefer overview: Volumes are otherwise down seasonally, though, despite the deep, dark Hot States Map above. Again, ELDs and weather have kept capacity tight, but if load counts continue to fall, then reefer rates may have crested – barring any big weather disruptions.

Hot markets: Nogales, Ariz., was the only produce-shipping market to post any big rate increases last week, as many others were down significantly. One interesting lane was Green Bay, Wis., to Minneapolis, which jumped up 48 cents to an average of $3.49 per mile – possibly a Super Bowl effect? Minneapolis is hosting the game, and around this time last year we saw inbound rates rise to Houston, where last year’s game was held.

Not so hot: While rates were largely stable in potato shipping areas like Twin Falls, Idaho, reefer prices dropped sharply in other produce-shipping markets like Miami, Sacramento and Lakeland, Fla.

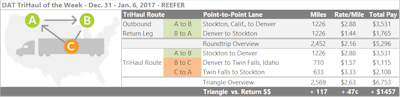

Denver is often where trucks go to die, but reefer load-to-truck ratios have been pretty favorable for carriers lately. If you can make it work with your hours of service, splitting the haul out into two segments could get you around some of the lower-paying reefer loads. For example, reefers from Stockton, Calif., to Denver paid an average of $2.88 per mile last week. The return trip averaged just $1.44, which works out to a $2.16 average for the round trip. You can improve your revenue by hauling a reefer load from Denver to Twin Falls, Idaho, instead. That lane still only paid an average of $1.57 per mile, but it would put you in position to go from Twin Falls to Stockton, which averaged $3.33 per mile. Average three-leg rate: $2.63, adding about 120 miles, plus-$1,500 in revenue.

Denver is often where trucks go to die, but reefer load-to-truck ratios have been pretty favorable for carriers lately. If you can make it work with your hours of service, splitting the haul out into two segments could get you around some of the lower-paying reefer loads. For example, reefers from Stockton, Calif., to Denver paid an average of $2.88 per mile last week. The return trip averaged just $1.44, which works out to a $2.16 average for the round trip. You can improve your revenue by hauling a reefer load from Denver to Twin Falls, Idaho, instead. That lane still only paid an average of $1.57 per mile, but it would put you in position to go from Twin Falls to Stockton, which averaged $3.33 per mile. Average three-leg rate: $2.63, adding about 120 miles, plus-$1,500 in revenue.