Trucking news and briefs for June 23, 2022:

Biden calls for fuel-tax holiday, urging Congress, states to act

On Wednesday, President Joe Biden held a press conference where he called for Congress to move on bills introduced earlier this year that would, through the end of 2022, exempt fuel purchasers from the federal fuels taxes – 24.3 cents per gallon of diesel currently. Biden specifically called for a three-month holiday.

The House bill, H.R. 6787, introduced in February this year, so far has drawn just a couple dozen cosponsors, all Democrats, and has otherwise languished with little action taken. The Senate version of the bill, S. 3609, also appeared a nonstarter with Republican senators and most Democratic senators as well, with just seven Democratic cosponsors.

At issue for many is the hit a national move toward a fuel-tax holiday would have on the Highway Trust Fund, along with worries over further increases in fuel demand sending prices higher.

American Trucking Associations President and CEO Chris Spear said his organization opposes the suspension of tax collection, calling it temporary relief that will undo much of the positive momentum of highway infrastructure improvements.

"After months of touting the passage of the well-funded Infrastructure Investment and Jobs Act – a much-needed investment in our nation’s roads and bridges – the Biden Administration wants to cut that same highway system’s primary source of funding with a suspension of the federal fuel tax," he said.

While the suspension of the tax won't add funds into the Highway Trust Fund, Biden called on Congress to ensure the fund remained whole. Citing a $1.6 trillion deficit reduction this year, the White House said Biden believes the tax can be suspended and the cost offset with other revenues.

Spear, rather, proposed that the administration work toward making the U.S. energy independent.

"Stop kissing the ring of Saudi Arabia," he said; renew trade agreements with the European Union and Asian Pacific nations in order to export more American oil and natural gas; and balance the budget. "Stop wasting hard-earned taxpayer dollars on senseless programs that drive up inflation and runaway deficits. Energy independence, trade and a balanced budget. Do that and America wins.”

The suspension of the tax could be risky as station operators wouldn't be required to pass through the savings, and it is the latest measure the administration has deployed in an ongoing effort to drive down fuel prices, which to date have not worked.

Reps from the Owner-Operator Independent Drivers Association did not respond to queries about the fuel-tax proposal in time to include here. Taxed or not, Tom Kloza, analyst with Oil Price Information Service, expects attention over the second half of the year to shift from gasoline to diesel because of low global inventories, demand that's likely to remain above supply and the stealthy nature of diesel prices.

"The public doesn't seem to care and realize that they are one of the pillars of 2022 inflation and beyond," he said.

The loss of Russian crude and diesel puts Europe in a bind, and Kloza said that means U.S. exports of diesel may continue to approach or exceed record levels.

"There is not much time to build U.S. [diesel fuel] inventories to reasonable levels. While I think mention of $6 to $8 gasoline prices are hyperbole, I can see diesel prices going to $7 to $10 per gallon," he said. "Not a base case but certainly this is a product that is fetching $70 to $80 bbl above crude. If you believe in a possible spike in crude to say $140 to $150 bbl, that suggests diesel prices at the refinery gate of $210 to $230, or approximately $5 to $5.50 (wholesale) per gallon or more ... Add various taxes and retailer margins to that price, and you can see where the $7 gallon handle is quite possible... Hard to see real relief for diesel."

[Related: California trucking at a crossroads: AB 5, $7 diesel and more]

Biden's White House statement noted a $10 billion cost in terms of lost revenue for his 90-day fuel-tax proposal, even as the administration urged states to take similar actions, as New York, Georgia and some others already have, though Georgia's suspension has expired, as have most others.

Refer to states' IFTA websites – New York's you can find at this ink, for instance – for how to report gallons purchased there during the suspension period.

[Related: Will only the strong survive historic fuel-price highs?]

CVSA April brake-inspection blitz results show OOS chafing violations make slight rise

Brake hose/tubing chafing violations were a principal focus of the April unannounced brake-inspection effort.

Brake hose/tubing chafing violations were a principal focus of the April unannounced brake-inspection effort.

On April 27, 46 jurisdictions in Canada and the U.S. put 1,290 commercial motor vehicles with brake-related critical vehicle inspection violations out of service – a 14.1% OOS rate for all vehicles inspected during the blitz that day. The unannounced one-day inspection and enforcement initiative, conducted by Commercial Vehicle Safety Alliance member jurisdictions, focuses specifically on the brake systems and components. CVSA-certified inspectors conduct their usual truck inspections; but for this initiative they also report brake-related data to the alliance.

- A total of 9,132 inspections were conducted.

- Of the total number of inspections conducted, 1,290 vehicles were placed out of service.

Inspectors compiled and reported brake hose/tubing violation statistics, which was the focus area for this year’s daylong blitz. There were 1,534 brake hose/tubing violations. CVSA asked inspectors to submit data on four categories of chafing violations:

- A category 1 violation is when the wear extends into the outer protective material. 32% of violations were identified as this category, not an out-of-service condition.

- In category 2, wear extends through the outer protective material into the outer rubber cover, also not an OOS violation. It was the largest category, with 37% of chafing violations encoded as category 2.

- In category 3, wear has made the reinforcement ply visible, but the ply remains intact – also not OOS. Just 13% of violations were encoded here.

- The most severe category 4 violation is an OOS condition, where chafing has caused part of the fabric/steel brain reinforcement ply to be frayed, severed or cut through. 18% of violations were category 4.

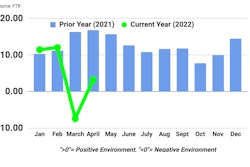

As of April this year, CVSA's updated North American Standard Out-of-Service Criteria amended category 4 to make any tubing/hose damage resulting in the fabric/steel braid reinforcement ply being frayed, damaged or cut an out-of-service violation. Accounting for combining 2021 categories 4 and 5 into one, this year's OOS chafing violations increased modestly from 17% to 18% as a portion of all chafing violations.

[Related: An assist for avoiding brake-adjustment violations]