This Overdrive poll ran with the October “Attention to detention” feature in two parts. Follow this link for the first part.

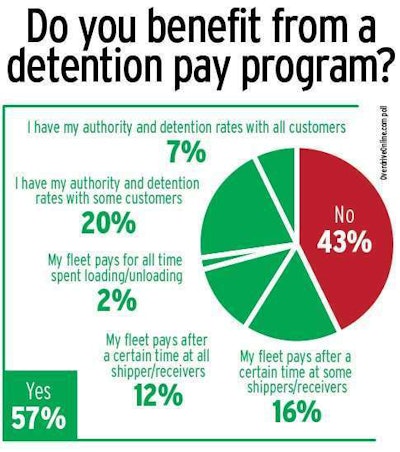

This Overdrive poll ran with the October “Attention to detention” feature in two parts. Follow this link for the first part.The Transport Capital Partners group’s fourth-quarter industry survey showed 43 percent of carriers large and small felt they would be able to renegotiate detention in contracts with customers. As Overdrive reported in the October report on detention — particularly focused on how carriers treat it — negotiation of detention rates often results in productivity gains for both drivers and carriers.

As the TCP organization put it, “while renegotiating detention times does not necessarily raise cash, it can make equipment more productive.”

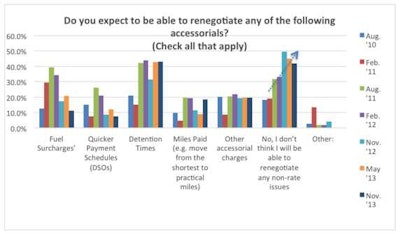

Click through the image for a full-size version of Transport Capital Partners’ graph of their most recent quarterly survey results relative to accessorials. Follow this link here for full quarterly survey results.

Click through the image for a full-size version of Transport Capital Partners’ graph of their most recent quarterly survey results relative to accessorials. Follow this link here for full quarterly survey results.However, the organization notes, on the whole as many carriers as are positive on detention continue to be somewhat negative on other accessorials in freight contracts — 42 percent of carriers surveyed this quarter indicated they do not expect to be able to renegotiate. Over the last two years, the number of carriers able to raise fuel surcharges has dropped from 30 percent to 11 percent, for instance, and pessimism about accessorials is greater among smaller carriers than the larger carriers (50 percent vs. 38 percent, respectively).

Approximately 30 percent of larger carriers think they will be able to renegotiate miles paid (i.e., move from shortest route to practical route), TCP reported. This change – were it to materialize — would have a significant impact on revenues (and driver pay), even with stagnant rates.