DAT’s Matt Sullivan points to “something of a perfect storm” to close out the last full week of 2017 for van rates. “We had bad winter weather in many areas, plus people taking extra days off for the holiday and the urgency to get shipments delivered before the end of the year. All of that was taking place while the industry adjusts to the ELD mandate,” leading higher rates for vans “almost everywhere.”

For the past few years “we’ve seen rates continue to climb through the middle of January” in a sort of extended holiday season, Sullivan adds, “boosted by gift card redemption, restocking and e-commerce. After that would be the normal February doldrums, during which we might get a clearer picture of the ELD effect on the spot market.”

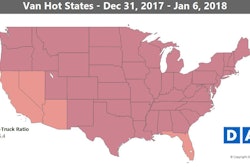

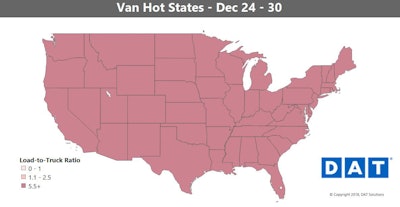

For the past few years “we’ve seen rates continue to climb through the middle of January” in a sort of extended holiday season, Sullivan adds, “boosted by gift card redemption, restocking and e-commerce. After that would be the normal February doldrums, during which we might get a clearer picture of the ELD effect on the spot market.”Van overview for the last week: Truckload capacity on the spot market was already tight before Christmas, but the load-to-truck ratio for dry van freight went through the roof to close the year. The national average for the week was 12.3 van loads per truck, breaking the record set the week before. The national average van rate for December was $2.11 per mile, the highest in three and a half years.

Last week’s higher prices were less about higher volumes, though. Load counts on the top 100 van lanes were down, even when you consider the shortened work week due to the holiday. Still, rates rose on 76 of those lanes, so the higher prices were a result of trucks being harder to find, and perhaps the urgency to move loads before the end of the year.

Winter weather also played a role, reducing volumes in the Midwest and Northeast, but also making it harder for trucks to operate in those regions.

Hot markets: But as you can tell in that map above, winter weather wasn’t the whole story. This is probably the first time that every single state on the map has been dark red, though it got close the last week of November and has remained mostly dark red through December. Dallas was once again the market with the biggest uptick in average rates, up another 10 percent from the previous week. Rates on the lane from Chicago to Detroit also jumped up 42 cents after Christmas to an average of $3.97 per mile.

Not so hot: Seattle was once again the only major van market where the average price fell. Rates there were down 11 percent in December, but those prices are coming down from what would be considered well above normal for this time of year. Recent declines could be adjustments to rates that are more typical for that market.

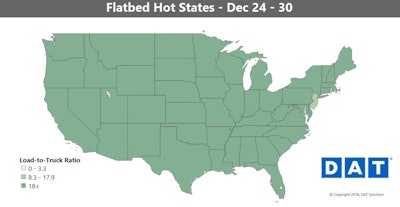

You can see from the flatbed map that capacity is tight, with average load-to-posted-truck ratios high, for that segment as well. Rates have otherwise stayed pretty close to where they were before Thanksgiving, though. Not that flatbed rates have been bad – they just haven’t kept climbing the way van and reefer rates have.

You can see from the flatbed map that capacity is tight, with average load-to-posted-truck ratios high, for that segment as well. Rates have otherwise stayed pretty close to where they were before Thanksgiving, though. Not that flatbed rates have been bad – they just haven’t kept climbing the way van and reefer rates have.Flatbed hot markets: Flatbed freight out of Baltimore usually heads to the Northeast and Midwest. Since the weather made shipments to those regions more difficult, average rates for loads originating in Baltimore rose 10 percent last week. Houston had the next biggest increase at 3 percent, while Los Angeles and Phoenix were also strong for flatbed in December.

Not so hot: Dallas and Memphis had the biggest drops for flatbed rates last week, and average prices in both markets dropped in December compared to November. Tampa, Fla., to Atlanta is one of the weakest flatbed lanes, and the average rate was down another 7 cents to just $1.39 per mile. That’s low, but it’s actually 4 cents higher than a year ago, mostly due to higher fuel prices.