After a 16% drop the previous week, spot truckload freight volume fell another 8% during the week ending July 28, said DAT Solutions, which operates the DAT network of load boards.

More van and reefer loads out of California help halt a further decline, as spot loads of summer produce soaked up capacity and kept trucks busy with longer hauls. Nationally, the number of available trucks searching for loads dipped 1.6% compared to the previous week.

National average spot rates, through July 28

*Van: $1.85/mile, 4 cents lower than the June average

Reefer: $2.19/mile, 7 cents lower than June

Flatbed: $2.28/mile, 2 cents lower than June

Trend to watch: Flatbed volatility

Spot flatbed rates normally peak in Q2 but this year they hit their high mark around the July 4 holiday, when the national average was up near $2.30/mile. Rates have slipped since then and are now 2 cents lower than the June average.

Overcapacity remains the chief obstacle to pricing power. Trucks are readily available in many parts of the country as oil and gas activity, heavy-equipment moves, and new-home construction are growing at a slower pace than expected and manufacturers report letting raw materials inventories dwindle.

For now, flatbed remains the most volatile segment in the spot market.

Market to watch: California reefers

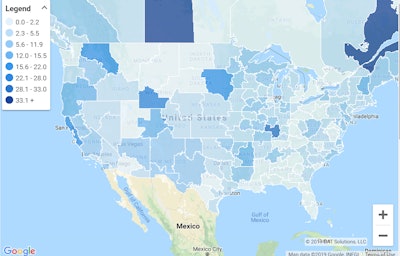

Reefer load counts are up in California. Last Friday, the load-to-truck ratio hit 20.4 in the San Francisco market, which includes Watsonville and Salinas. Darker shades indicate more load posts compared to truck posts.

Reefer load counts are up in California. Last Friday, the load-to-truck ratio hit 20.4 in the San Francisco market, which includes Watsonville and Salinas. Darker shades indicate more load posts compared to truck posts.Spot reefer volume rose 4% last week and rates were higher on 35 of DAT’s top 72 reefer lanes, so there’s good news for ag haulers who have been eager to put a tough spring behind them.

One of the standout markets for summer produce is San Francisco, which includes Watsonville and Salinas, the “Salad Bowl of the World.” Last Friday, the load-to-truck ratio there hit 20.4; last week’s national average was 3.5.

Sacramento was solid as well. Compared to the previous week, spot reefer volume was up 12% and the average outbound rate was 8 cents higher at $2.86/mile.