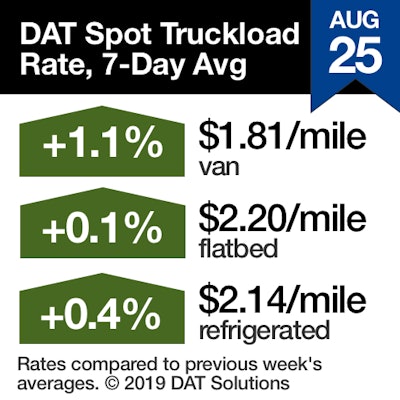

There are signs of it in data from the DAT network of load boards for the week ending Aug. 25. Spot pricing held firm, despite a 3% drop in the number of posted loads, said DAT Solutions. The number of posted trucks increased 2.6% compared to the previous week.

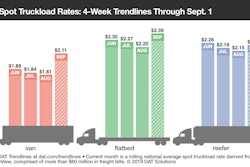

Van and reefer pricing has been virtually unchanged in recent weeks, a sign that spot rates have hit a seasonal low prior to Labor Day. For prices show here, van was 3 cents lower than the July average, flatbed 7 cents lower, and reefer 5 cents.

Van and reefer pricing has been virtually unchanged in recent weeks, a sign that spot rates have hit a seasonal low prior to Labor Day. For prices show here, van was 3 cents lower than the July average, flatbed 7 cents lower, and reefer 5 cents. At a time when it’s typically rising, the reefer load-to-truck ratio fell from 4.7 to 4.4 last week.

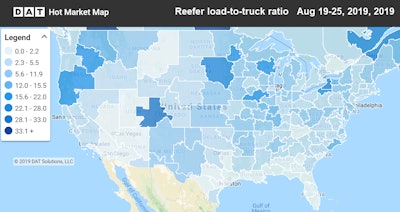

At a time when it’s typically rising, the reefer load-to-truck ratio fell from 4.7 to 4.4 last week.Trend to watch: Reefers in a rut

Late-summer fruit and vegetable harvests in the Midwest and California have not made up for markets where production has struggled due to weather. The national average reefer load-to-truck ratio fell from 4.7 to 4.4 and rates were higher on just 24 of DAT’s 72 high-traffic lanes for temperature-controlled freight.

Reefer markets have been waiting for a seasonal uplift but so far that hasn’t happened. Of the few reefer lanes with higher rates, the bigger increases were on low-volume routes. Demand for reefer trucks was heaviest in California, where the number of available loads was up in Los Angeles (9%), Fresno (8%), and Ontario (6%). Rates in these market were softer compared to the previous week, however.

Market to watch: Columbus vans

Van volume on DAT’s 100 top van lanes was up 3% last week but pricing changes were muted. Forty-four lanes were higher, 47 were lower, and nine were neutral compared to the previous week, with no dramatic swings either way.

Columbus, Ohio, volumes are up almost 3% over the past four weeks — that’s a surge, relatively speaking. The average outbound van rate from Columbus jumped 5 cents to $2.13 per mile last week but that tells only half the story. Inbound freight was weaker: for instance, the average rate from Columbus to Buffalo was the biggest gain last week while the biggest drop was the return trip from Buffalo to Columbus:

**Buffalo to Columbus: $1.85 per mile, down 10 cents

**Columbus to Buffalo: $2.82 per mile, up 13 cents

The threat of new tariffs on Sept. 1, plus the effect of disappointing harvests, continue to keep van markets in check as the national average van load-to-truck ratio slipped from 2.4 to 2.2. With Labor Day around the corner, we’ll see if patterns hold and demand picks up.