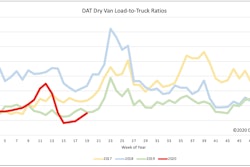

Spot truckload van and refrigerated freight volumes climbed again in the most recent week, as the number of truck postings dropped 17.5% during the week ending May 17, said DAT Solutions, operator of the DAT load boards network.

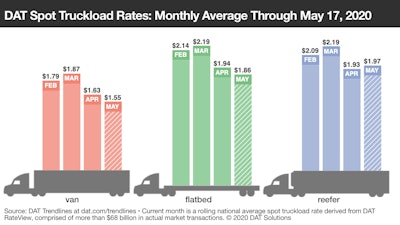

After the extreme turbulence of March and April, national average rates are firming up but remain well below last year’s averages.

The van average rate as of the 17th sat 8 cents lower than the April average, as did the same for flats. Reefer’s average was 4 cents higher, however.

The van average rate as of the 17th sat 8 cents lower than the April average, as did the same for flats. Reefer’s average was 4 cents higher, however.Trend to watch: Truck posts

Rates were higher or neutral on 78 of DAT’s top 100 van lanes by volume compared to the previous week. Overall, the number of van loads moved on those 100 lanes increased 5% week over week and was higher or neutral on 77 of those lanes.

More spot freight is good news for carriers, especially in the van market, but it’s hard to overlook the 17.5% reduction in the number of posted available trucks last week. Fewer trucks on the spot market is a signal that capacity is shifting to contract freight as economies open up. Yet relatively flat pricing and load-to-truck ratios mean there’s still plenty of available equipment for shippers and brokers.

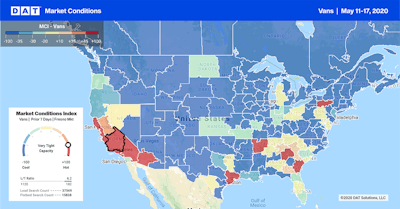

The DAT Market Conditions Index for vans highlights bright spots for freight, with California leading the way. Overall, the picture is a lot more optimistic than it was a few weeks ago.

The DAT Market Conditions Index for vans highlights bright spots for freight, with California leading the way. Overall, the picture is a lot more optimistic than it was a few weeks ago.Market to watch: California’s Central Valley

California’s Central Valley includes the markets of Sacramento, Fresno, Bakersfield and Stockton and produces more than half of the fruits, vegetables, and nuts grown in the United States and 8% of the country’s agricultural output by value.

Spot reefer freight in the region appears to be building toward its typical June peak.

In Stockton, the average outbound reefer rate has increased from $2.25 a mile at the start of May to $2.53 a mile last week on a 4% jump in the number of loads moved during that time frame. Stockton vans are improving, too. The average outbound van rate was $1.78 a mile last week, up from $1.65 at the start of May on a 6.5% increase in volumes.

At $2.36 a mile, the average reefer rate from Fresno is up 44 cents since the start of the month on a 3% increase in load volumes. On the van side, Fresno had a load-to-truck ratio of 6.2 last week and was one of the hottest markets on the DAT Market Conditions Index.

Looking ahead

Dry van spot rates have bounced off their lows and found support at their current levels, which are comparable to 2016, rough as that year itself was. The shorter-term charts show no signs of reversal in the trend, but do indicate that we may hang around at these rate averages until there’s a more material shift in demand. Reefers continue to outperform vans and have actually turned positive year-over-year. The seasonal trend is stronger for reefer freight and carriers should benefit from the reopening of restaurants and other food-service venues in many states.