Previously in this series: Buying money, buying time: Survival strategies for cash-strapped owner-operators

With many small fleets and independent single-truck operators having suffered financially under the coronavirus-related economic restrictions, many face difficult decisions on dealing with excessive debt, as reported in the previous part of this series. That installment detailed, among other things, traditional U.S. Small Business Administration loans and SBA’s new Paycheck Protection Program, the most common source of lending for small businesses in recent weeks, given the loans can be forgiven.

This installment examines private lending resources, as well as strategies other than borrowing, that an owner-operator or small fleet business could tap to help manage a cash-flow crisis.

Prior to the coronavirus outbreak, banks offered lines of credit up to $100,000 with monthly payments at rates between 10% and 12%, said Seth Nelson, who heads the SBA lending arm of Fundera, an online marketplace that links small-business borrowers with lenders. Loans with similar terms also were made on fixed terms, he said. Most such loans have repayment over one to five years.

“Most of the lending that’s available on our platform right now is through the Paycheck Protection Program,” Nelson said, since the program is far more advantageous to the bank and the borrower. Lendio says of its clients this year, “more than 1/4 of the loans facilitated for small trucking companies have been SBA PPP loans.”

MERCHANT CASH ADVANCES. MCAs are a form of factoring, where payment to the client is tied to receivables, so technically they’re not considered loans. Typical repayment is expected in six to 12 months.

Because payment is based on a percentage of receivables, the exact time to repay depends on the volume of business coming in. Unlike SBA and bank loans, MCA providers require little in the way of qualifying and make money available in a day or two.

Rates are high and often expressed in terms that are difficult to compare to annual percentage rates (APR). Clients allow the provider to make automatic nightly withdrawals from their checking accounts and also sign away rights to their business assets in the event of default.

Late-payment penalties are stiff and can quickly inflate the effective APRs. Many small businesses have reported being caught in a hopeless chain of taking out additional MCAs to manage repayment.

The Federal Trade Commission and others have expressed concerns about many MCA providers that use aggressive and misleading tactics.

Part 3 of the Cash Flow Crisis series will focus on the use of MCAs by hundreds, if not thousands of small fleets and brokers.

While some small fleets have been able to stay active during the spring, others have not, victims of extremely low freight rates and certain niches hit hard by the global economic slowdown.

While some small fleets have been able to stay active during the spring, others have not, victims of extremely low freight rates and certain niches hit hard by the global economic slowdown.FACTORING. Companies that buy carriers’ receivables have long been used by fleets that need a more dependable, consistent cash flow. Most of the smallest carriers, including independent owner-operators, choose non-recourse factoring, where the factor pays the client for the full invoice up front, so that in most cases there is no loss to the client even if the shipper fails to pay the invoice. The factor keeps a small percentage of the invoice. In recourse factoring, that percentage is lower because the client is responsible to paying the money back if the factor fails to collect on an invoice.

There are big differences between MCAs and traditional factoring. Instead of MCAs’ provision of an initial lump sum to the client, factors pay only as invoices come in.

Non-recourse factoring rates are typically 4-6%, while MCA rates start much higher and can expand to effective rates above 100% when computed on an annual percentage rate basis, depending in part on default penalties.

Reputable factors don’t charge other rates or penalties, so a factoring client doesn’t face costs that escalate as the repayment progresses. The factoring client doesn’t have to pledge business or personal assets as part of the arrangement.

Part 2 of the Cash Flow Crisis series next week will focus on factoring for small fleets.

DEBT CONSOLIDATION. Whether it’s due to unwise use of exploitative MCAs or other indebtedness, small businesses can find themselves needing to refinance debt at a lower rate over longer terms that allows them to keep operating. As with getting any business loan, the first step is to figure out the best type of loan you could qualify for, based on your financials, prospects and experience.

“If you’re a trucking fleet and you’ve been in business for a year, unfortunately you won’t be eligible for an SBA loan, which requires that you’re in business for at least two years,” Nelson said. In that case, the next consideration might be to consider qualifying for a medium-term bank loan.

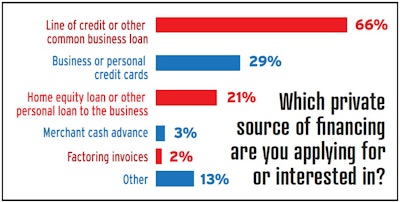

About three in 10 respondents to Overdrive‘s mid-May reader survey related to COVID-19 impacts said they are seeking financial aid from private sources apart from the federal Paycheck Protection Program, or considering doing so. Of those, many are tapping more than one source.

About three in 10 respondents to Overdrive‘s mid-May reader survey related to COVID-19 impacts said they are seeking financial aid from private sources apart from the federal Paycheck Protection Program, or considering doing so. Of those, many are tapping more than one source.DEBT RELIEF. Every year, McCarthy Law PLC of Scottsdale, Arizona, sees hundreds of clients with unworkable MCA debt, said principal Kevin McCarthy. That includes truck fleets.

His firm is usually able to secure a debt reduction that is substantial even after legal fees. The goal is to reduce the debt to 40%, with another 20% covering legal fees. A debtor owing $100,000, for example, would still be responsible for $60,000, he said.

Results vary widely, McCarthy said, since the responsiveness of MCA providers ranges from complete inflexibility to being very cooperative, given that most creditors would rather get something than nothing. The business strength of the client – the ability to repay under new terms – is also a key factor.

Nelson said he doesn’t recommend such negotiations for desperate small businesses. Not only is there a sizable attorney’s fee, but “you’re defaulting on a certain portion, and that could impact your credit and other things, depending on how the lender reports to the credit bureaus.”

PERSONAL LOANS. “Friends and family get overlooked,” Nelson said. It’s not uncommon for Fundera clients to use some degree of personal lending to start a business or get out of a bind, he said.

Ondeck, one of the bigger online providers of business loans, also notes this is a common source and can be structured as an equity investment instead of a loan. “While you don’t make regular loan payments to an investor,” says the ondeck.com website, “in exchange for their capital, they receive a percentage of equity in your business that will return a profit at some point in the future — perhaps once the business is profitable, or when the business sells or recognizes some other liquidity event.”

It’s recommended to put in writing the terms of any such investment and to treat it as seriously as one from a commercial lender.

BORROWING FROM RETIREMENT SAVINGS. Perhaps you have 401(k) savings from prior work as a company driver. Or you or your spouse have Individual Retirement Account savings. These can be attractive funding sources, but with few exceptions, withdrawals before you turn 59.5 will incur a 10% tax penalty. However, you can borrow from a 401(k) and pay back the money over five years. Interest accrues to your account, but there is no penalty.

CREDIT CARDS. The plastic in your wallet is tempting as long as you haven’t maxed out your credit limits. Used responsibly, credit cards can be a good way to build your credit rating, and many offer attractive incentives, such as cash back.

However, because of high interest rates and the ease of getting over your head with debt, they’re not considered a good tool for managing risky business debt. Unpaid balances, as well as applications for too many cards, will damage your credit rating.

BANKRUPTCY. Filing for Chapter 11 bankruptcy – a plan to reorganize debt while continuing to operate – often isn’t a good choice for a small business. Chapter 11 is an expensive process that usually drags out over years. It’s more often used by large corporations, though a small business can find it more favorable than Chapter 7 bankruptcy filing because it gives a longer time – 180 days – to work out arrangements with creditors. Chapter 7, which allows only about two weeks, is intended for liquidating assets to pay debts.

The filing fee for Chapter 11 is higher than what’s required for Chapter 7. Chapter 11 also can have higher court costs.

For an owner struggling with excessive MCA debt, bankruptcy can lead to other problems, McCarthy said. In the typical MCA agreement, the business owner forfeits protection of his personal property.

“The owner says if the company won’t pay, you can look to me to pay, which puts their assets at risk,” McCarthy said. The MCA provider, for example, doesn’t get a lien on the client’s house, “but they get a right to chase their house.” When no other payment is forthcoming, some providers will do just that.

The firm’s MCA clients often don’t realize they’ve signed away that protection. Some of those who do were often victims of their own “entrepreneurial spirit,” he said, believing they can work their way out of any fix.

Next in this series: Sharing risk: Load factoring offers strategic value amid economic contraction