What’s next on 2020’s rollercoaster ride? Analysts weigh in on what has been and what might be. Of note: West Coast imports are surging as the retail boom continues, but concern remains for a lagging industrials and manufacturing sector.

What’s next on 2020’s rollercoaster ride? Analysts weigh in on what has been and what might be. Of note: West Coast imports are surging as the retail boom continues, but concern remains for a lagging industrials and manufacturing sector.In large part, on the spot market anyway, 2020 has been a tale of two seasons, as many owner-operators and small fleets have experienced first hand in their own dealings.

The ghost town that befell spot freight for a roughly two-month run amid shutdown orders due to the COVID-19 outbreak in April and May has since rallied into something of a boom town.

After rates cratered in April and May, the subsequent supply chain chaos combined with a boom in demand for loads-producing goods like appliances, homewares, home-office-wares, exercise equipment and lumber, to name a few hot commodities, has poured freight into the spot market.

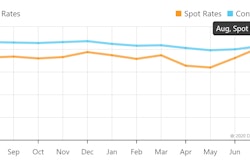

That surge in load volumes has driven per-mile spot rates to those on par with some months in 2018 — considered by many to be the spot market’s recent-history high-water mark. The good news is load volumes are expected to remain strong on the spot market at least through year’s end, layering the holiday retail rush on top of the already-robust retail sector.

The bad news is that, underneath that retail surge and supply chain chaos, a lingering weakness in the industrials and manufacturing sectors could remain a drag on prominent freight-producing sectors in the economy.

Should the retail spending cool, and industrials and manufacturing not pick up, freight volumes could again hit a down cycle.

“Structurally, it becomes a question mark,” said FTR CEO Eric Starks, referring to retail carrying the economic recovery. “Can this type of strength continue? I have been one of the more pessimistic people out there” regarding the pandemic’s impacts on the economy. “I’m waiting for the data to show up and say ‘It’s all good, and we’re back to normal.’ But so far, I haven’t seen that.”

One positive-case scenario would be for manufacturing and industrial goods movement to pick up as retail spending slows, which would keep freight volumes solid. “That would be fantastic,” Starks said. But data so far doesn’t show whether that will be the case. Starks spoke last week in one of FTR’s ongoing Engage series of webinars.

Likewise, though the spot market is a strong indicator of what’s going on with freight, “the spot market is not the freight market,” said Avery Vise, FTR’s vice president of trucking. “Overall, the freight market clearly has not recovered to the degree the spot market has.” Spot freight typically only accounts for around 10%-15% of all freight movement.

FTR projects overall truck loadings to drop by 6% in 2020 compared to 2019, then climb by 6% in 2021. However, volatility in economic data is prompting FTR to update its forecasts monthly.

“The big word for the last few months has been ‘imbalance,’” said Chris Caplice, an analyst for DAT Solutions and executive director of MIT’s Center for Transportation and Logistics. “Some industries cratered. Some lanes disappeared. Other lanes went up by three times. For both carriers and shippers, the network that is typically kind of balanced is now out of whack.”

Overall, total net freight volumes are roughly on par with last year, though it’s hard to pin down exactly, said Ken Adamo, chief of analytics for DAT. “Industrials are lagging so hard,” he said. “That’s such a big part of the domestic freight economy, it’s hard to outrun that.”

But while industrials – such as loads to and from manufacturers – have stumbled, other freight sectors have picked up. Think March and April’s surge to restock grocers and, since then, the retail boom in areas such as furniture, appliances, home goods, exercise equipment and residential construction. “There have been some weird silver linings with the pandemic and how people have reacted,” said Caplice, referring to those targeted spikes in consumer spending.

Goods producers and many food makers have had to find new suppliers to keep up with the unexpected surge in demand. What that means, said Caplice, “isn’t just new suppliers, but all-new lanes” for freight to get where it’s needed. Those new suppliers and new lanes are another contributor to the jolt in the supply chain.

“Networks have fundamentally shifted. We know the narrative,” said Bill Dreigert, head of operations at Uber Freight, noting consumers are staying home and spending more on home goods, groceries and other retail items, much of which is being purchased through e-commerce channels. Likewise, beverage providers, for example, are seeing a surge in demand for groceries while restaurant sales have “dropped off a cliff,” he said.

“Each of these networks have different origins and destination points,” he said, which is causing “demand and supply to shift to different markets and different lanes.” Though the current surge in spot rates should drive more truck capacity to market, “it’s not something that can be solved overnight.”

Vise projects the market to calm, whether due to a return to more predictable freight patterns or, simply, carriers and shippers adjusting and building out new networks to handle the shift in freight and demand.