"If you’ve ever hunted when you’re hungry, you know you get a lot better at hunting," said Criss Wilson, data scientist with transportation management software provider McLeod. "When you’re starving for profit, you’re at a point when you can be very, very smart."

Wilson made the analogy as part of a presentation delivered at the Truckload Carriers Association's annual convention in early October in Las Vegas. His session stated the case to the mostly asset-based carrier representatives in attendance for another way to look at rates when negotiating with shipper clientele over annual or increasingly short-term freight contracts.

Chiefly, Wilson believed rates "averages," even when computed with granular detail on a lane-by-lane and segment-by-segment basis, could obscure valuable insights to be gained by viewing rates across the entire spectrum, more in line with the kind of market that truckload freight exists in. "Historical rate data is essential for us to do good quality rate analytics," he said, yet so much depends on data quality and the way rates are presented.

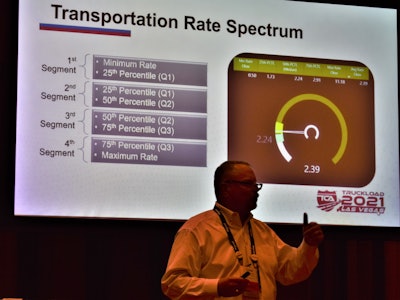

Wilson and McLeod are developing a tool to deliver insights from anonymized data from TMS customers among brokers and asset carriers that centers rate/lane analysis not solely in lane averages but rather by viewing the entire collection of rates examples/records across a spectrum, with four parts, or quartiles, made up of an equal number of rate observations.

In a set of data with 1,000 total rates arranged from lowest to highest, the 250th record is the boundary between Quartile 1 and Quartile 2. The 500th record sits at the 50th percentile, and represents the median of the entire set and the boundary between Q2 and Q3. And on up to the 1,000th record at the end boundary of Q4.

"If I showed you the rates in this form or fashion" along a line, "you might take something away from it but it’s not intuitive," Wilson said. Overlaying it with something that any trucker can understand, a tachometer, and pointing out where the quartile ranges fall as it relates to rates, he believed, can give rates decision-makers a way to quickly see pressures where they exist. See an example he gave below.

In this example of rates during a particular time period on the lane from Dallas to Atlanta, the needle sits on the computed average rate on the spectrum of observations, which ranged from loads moved at 50 cents a mile on the low end to $11.18/mile at the top. That $2.39 average is parked just above the median rate in the set, also shown, at $2.24, which Wilson notes indicates generally upward market pressure on this lane. "If the average is greater than the median, that’s upward rate pressure ... Asset carriers still have room to run" when it comes to negotiating leverage with customers for price increases. Using this kind of tool, he believed, "I can teach a rookie dispatcher the subtleties of pricing in about 20 minutes. Rate analytics gives that rookie dispatcher something it took five years or more for that competent operator to master." He urged carriers to use rate analytics to help themselves "supplant the lessons that occur from 10,000 hours of practice."

In this example of rates during a particular time period on the lane from Dallas to Atlanta, the needle sits on the computed average rate on the spectrum of observations, which ranged from loads moved at 50 cents a mile on the low end to $11.18/mile at the top. That $2.39 average is parked just above the median rate in the set, also shown, at $2.24, which Wilson notes indicates generally upward market pressure on this lane. "If the average is greater than the median, that’s upward rate pressure ... Asset carriers still have room to run" when it comes to negotiating leverage with customers for price increases. Using this kind of tool, he believed, "I can teach a rookie dispatcher the subtleties of pricing in about 20 minutes. Rate analytics gives that rookie dispatcher something it took five years or more for that competent operator to master." He urged carriers to use rate analytics to help themselves "supplant the lessons that occur from 10,000 hours of practice."

"Start to look at the rates like this," Wilson said. "If your service provider isn’t giving you the rates like this," suggest it, he added.

Keep in mind the danger of not including like observations in any dataset -- there's a big difference between asset carrier rates and what a broker will be able to collect from a shipper, for instance. Including both in a single set will cloud the veracity of observations. Considering both together is "good for a macroeconomic trend analysis," he said, but "if you're figuring out what kinds of rates you're charging," stay away from mixing such figures, he advised.

[Related: What is your time worth?]

The promise of data-sharing in rate analytics

Wilson is on something of a "crusade," he said, with asset-based carriers to share data amongst themselves for better intelligence for all. He believes rate analytics holds the potential to lift insights out of the wisdom of crowds by aggregating anonymized data in the cloud to "contribute our information to understand the crowd wisdom" that emerges, he said. "When you are tapping market intelligence by sharing your rate data, you’re smarter."

He believed reward would come from "what we know together" as a trucking community writ large. "If you take 100 people and ask them to solve a problem, the average answer from that group will be at least a good as the answer from the smartest person in that group – humanity is smarter together than we are apart. ... Using segmented rate data is where we find where the pockets of money exist."

So-called descriptive rate analytics, looking at "what happened in the past," he believed, can "make your team a better negotiator."

Prescriptive analytics then should be the goal -- using what happened in the past to inform moves into the future for the business. Fundamentally, sharing fulfills another goal he believes any trucking company would get behind. "We want good competitors, healthy competitors, well-funded competitors – we don’t want reverse auctions, chasing that rate to the bottom. You do have leverage against them – what you know and the willingness to share collectively what you know with others, to see what’s about to happen before the shippers do."

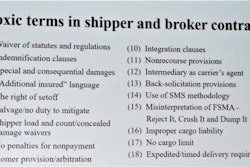

[Related: Broker-shipper contractual shenanigans in practice ... again]