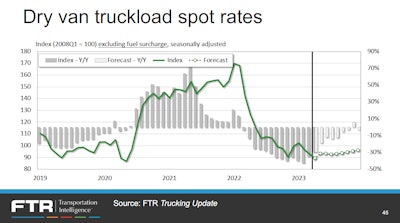

For owner-operators and fleets looking for some news to lend a little hope for the near-term future, the spot market is at the bottom and may have already turned the corner to the positive direciton. That's according to the analysts at FTR Transportation Intelligence, who presented the latest edition of its "State of Freight" online seminar series Thursday, June 8.

The freight outlook is slow-growth for some time to come, said FTR Trucking Vice President Avery Vise, yet for dry van and reefer rates, "essentially we're at the bottom" in the spot market, he said, forecasting modest gains through the end of this year, slighter larger for reefer.

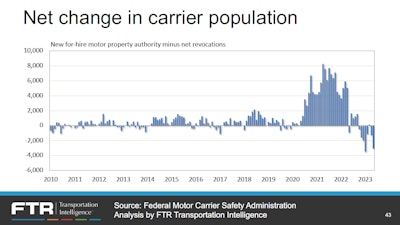

Part of what leads that analysis are fairly stable signals in wider economic numbers and signs that trucking is losing capacity throughout as entities of various sizes lose authority at a greater rate. After the explosion of new authorities post-pandemic, the trend reversed itself in October last year, "with very large declines this year" in net authorized carriers, Vise said. Most carrier losses are smaller entities, including small fleets and independents, but more sizable fleets are mixed in.

[Related: In a tough spot market, strong relationships with those who feed you will pay off]

"In the first five months of 2022," Vise said, trucking "lost 10 carriers of 100 or more trucks," yet this year over the same period the net loss is 31 carriers of that size.

The tide has turned for increasing competition in the spot market, as carriers continue to lose authority in much larger numbers than new carriers start up, according to FTR's analysis of the Federal Motor Carrier Safety Administration's registration system.FTR

The tide has turned for increasing competition in the spot market, as carriers continue to lose authority in much larger numbers than new carriers start up, according to FTR's analysis of the Federal Motor Carrier Safety Administration's registration system.FTR

The Bureau of Labor Statistics' trucking employment numbers too suggest "we're truly starting to lose capacity," Vise said, with an end to large-carrier hiring spree that was seen in the second quarter of last year and "to a lesser degree in the third." Contract market rates, FTR projected, were likely to continue falling through the year for dry vans even as spot rates made some gains.

"The contract market still hasn't bottomed out, but we’re getting close," Vise said. Contracts tend to follow the spot market up or down with time after spot gains or losses, as shippers and carriers renegotiate longer-term rates, "Large year-over-year declines" for the contract market "will moderate in late Q3/Q4 – that puts us in dry van similar to where we were in 2018 [for rates], but costs are a lot higher."

It was a fact -- the difficulties of higher costs -- Vise was careful to make throughout the presentation whenever freight rates were mentioned, though there has been at least some relief on fuel costs this year so far.

[Related: Diesel continues slide, rates maintain, in the latest week]

Inflation in the wider economy -- commodities tamed, services still on the way up

Vise noted that the Consumer Price Index shows commodity price inflation, even for food, has come down to more or less normal levels. Yet services inflation hasn't "clearly peaked," he said, holding import for possible further interest-rate benchmark increases by the Federal Reserve. "The Federal Reserve may pump the brakes" on increases, but they're "not exactly signaling they’ll stop" increases altogether.

Personal savings rates among Americans have fallen below long-term averages of 7%-8% since last year, he added. "That's a red flag to many" of economic pain to come. Yet there's "still a lot of cash out there," he added, even among households in the bottom 50% of incomes, according to the Federal Reserve's deposits and currency estimates. "We're still looking at toughly $100 billion dollars more" in household reserves than levels pre-pandemic.

"We’re in this area where consumption could continue at the level we’ve seen for quite a while," Vise said. "It could be the third quarter of next year before consumers are – in broad terms – starting to hurt, though anecdotally they are hurting now in some areas."

The manufacture and sale of durable goods and autos/parts could be upsides for freight for the foreseeable future. Automotive in particular has been on an "upward trend since the middle of last year in sales," said Vise, for both autos and light trucks, with a surge in the seasonally-adjusted index for the sector in April to the "highest seasonally adjusted level we've ever seen."

[Related: Turmoil in the auto market buffs the shine off earning potential in car hauling]

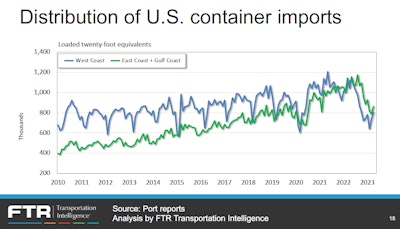

Levels of import activity from Mexico and Canada, considered together, have widened over imports from China, a possible impact of the late focus on manufacturing "nearshoring," with positive implications for domestic freight. Todd Tranausky, FTR vice president for rail and intermodal, shared data too that showed East and Gulf Coast container port activity gathering strength relative to West Coast volume.

Container import activity, broadly speaking, has come down since the latter part of 2022, yet "what we also see is that more recently we’ve seen it tick back up above where we were before the pandemic," above 2019 levels. Tranausky pointed to headlines of the last week with labor issues on the West Coast and a sailing vessel queue returning to bedevil California ports.

"Historically," said Tranausky, "the West Coast has always been the big dog" for container imports, but shares have shifted to the Gulf and East Coast ports to some measure in recent months, as shown. During the post-pandemic crunch at the ports out West, businesses of all types "went and looked at other alternatives," he added. "Houston, Savannah, New York." Clearly, "California's lost share to the Gulf and Southeast and Northeast."FTR

"Historically," said Tranausky, "the West Coast has always been the big dog" for container imports, but shares have shifted to the Gulf and East Coast ports to some measure in recent months, as shown. During the post-pandemic crunch at the ports out West, businesses of all types "went and looked at other alternatives," he added. "Houston, Savannah, New York." Clearly, "California's lost share to the Gulf and Southeast and Northeast."FTR

[Related: Intermodal haulers fight off 'system collapse' at ports as Biden pushes for more productivity]