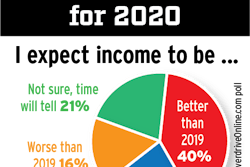

As I wrote a couple weeks back in tandem with the results of Overdrive‘s polling of the audience on business expectations in the new year, spot and contract rates toward year-end have shown some signs of converging, with spot rates rising and contract rates falling a bit for vans and reefers the last two months of the year, spot rates bumping up a bit for flats in December.

What that feels like where the 22.5s meet the road for many owner-ops, though, doesn’t line up with the notion that things are improving now. As a commenter posting as Mike noted under the previous story: “It is not getting better, as there are too many drivers and trucks out here. We are over capacity and these guys just keep coming.”

The feeling on the ground was summed up, too, by Walkabout Transport owner-operator Debbie Desiderato in conversation on Monday.

“I’m just struggling to find freight” that pays what it should, she said. “It’s just terrible. I don’t get it, with so many trucking companies going under last year, how come the rates don’t reflect that yet? I’m doing things like going back into New York City and stuff to try and make ends meet, and that’s just horrible. But you’ve got to do what you’ve got to do, I guess, to weather the storm.”

Part of an answer to her question about the bankruptcies of the last year might be what was proffered by Mike up top (to wit, the too many drivers and trucks out here part, elementally), but also consider this small part of a talk given recently by Avery Vise, VP of trucking at FTR, with further context courtesy of Overdrive‘s own James Jaillet, who heard the talk.

Vise pointed out that, despite a jump in the number of carrier bankruptcies and failures last year, capacity from those carriers isn’t leaving the marketplace. “We have to be clear on the distinction between carrier failures and capacity,” he said. Most carriers that go out of business or lose their authority (many of them owner-operators, he says) will either lease on to a carrier or sell the truck to another carrier and become a company driver. Often, carriers who have gone under will be picked up by another carrier. In those scenarios, “there’s no loss there” in capacity, he says. “It’s a very difficult thing to translate the failures rate to capacity.”

Ultimately, Vise says, should enough carriers fail, it could tighten capacity and put upward pressure on rates. As both Debbie and Mike also noted, that hasn’t happened. 2019’s failure rate – about 18,000 carriers all told losing authority, Vise says – is about par for the course for most years. Though a historically strong year for rates and trucking at large, 2018 saw 11,000 carriers lose their authority. In 2017, also a relatively strong year overall, about 17,000 carriers went under or lost their authority.

Truck utilization – a measure of the number of trucks actually operational in a carrier’s fleet – is around 89%, says Vise, which is below the 10-year average. So the number of carrier failures it would take to dent capacity is still large, he says.

The quarterly report of the U.S. Bank Freight Payment Index, out as of this morning, further underlines Desiderato’s sense of where things stand in the freight market — as she laid out in my podcast conversation with her a couple weeks ago, the owner-operator hauls a good deal of freight bound for trade shows, working with trusted brokers, among other commodities on occasion.

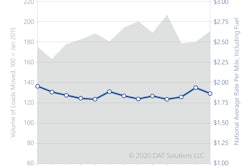

In this chart from the most recent quarterly report, including Q4 2019 results, U.S. Bank indexes tracking freight volume (shipments) and money spent on it (spend) are separated out. Interested readers can download the full report with regional results and more via this link.

In this chart from the most recent quarterly report, including Q4 2019 results, U.S. Bank indexes tracking freight volume (shipments) and money spent on it (spend) are separated out. Interested readers can download the full report with regional results and more via this link.As shown in the chart, there was no doubt less freight to go around last year, and though the report shows overall money spent on that freight inched upward over the course of the year, the rate gains achieved across the board in part of 2018 had a good deal better staying power last year in the contract market, not the spot market where so many owner-operator businesses live.

There’s difficulty inherent in a business strategy that relies exclusively on spot freight and, worse yet, what seasoned operators occasionally liken to playing “load board bingo,” as longtime small fleet owner-operator Monte Wiederhold called the strategy when pursued to the exclusion of any attempt at sustained direct business or established, reliable relationships with freight partners otherwise. He likened that to willing participation in “a slow death,” even with a factoring company handling receivables with the multiplicity of broker customers. “Having your own authority is great,” he said, but “you need direct customers to deal with. If you have that, using brokers to fill in makes it possible to operate on your own money.”

It also makes it more possible to sustain adequate profitability through a rough patch for spot freight.

Prognostications in U.S. Bank’s report forecast improvement in shipments and rates to truckers to be “sluggish into the second quarter,” the report’s authors write, in part given factory outputs continue to fall, viewed widely. Also: “Truck sales have exceeded the demand for the added capacity. … However, shipments could start to improve as capacity starts falling with fewer truck purchases as well as carrier closures.”

There’s hope in time. As Desiderato added, “it is January, and I keep forgetting that.” She laughed. “I want every day to be like December 23, when you call all the shots.”

—James Jaillet contributed reporting here from Avery Vise’s talk earlier this month.