Results from the final quarter of 2022 are in for the latest Bloomberg | Truckstop.com survey of owner-operators and small fleets about business conditions. Declining trucking conditions in some ways represent fertile ground for double-brokering scams, which appear to be back in full force after a holiday lull.

As any Overdrive reader who's experienced the topsy-turvy ride in the spot market the last year or so will know well, “spot rates are not in-line with the higher costs facing carriers, which is weighing on owner-operators' profits,” said Lee Klaskow, senior freight transportation and logistics analyst at Bloomberg Intelligence. “We expect the market to continue to rebalance with rates improving as early as 2Q."

In other words, Klaskow's hopeful for a Spring freight season akin to those in the good ol' days of yore -- we haven't really seen a typical Spring uptick in rates since (maybe) 2019, and maybe not even then. COVID spiked Spring freight in 2020, then 2021 was on a generally upward trend throughout almost the entire year, while last year rates jumped early with fuel then took a dive until more or less leveling out in the Fall.

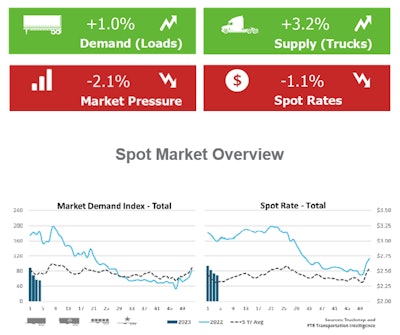

This week's FTR Transportation Intelligence/Truckstop.com spot market update snapshot shows the last years' trends to an extent, with top numbers showing week-over-week moves in metrics for the seven days ending this past Sunday:

As noted in the weekly report, rates have been falling overall since the holiday surge in December, though "the declines have tracked with seasonal expectations." Broker-posted rates in dry van and refrigerated, though, remain relatively close to the five-year average, FTR/Truckstop said. The strength of spot rates will become clearer over the next several weeks as they typically begin to firm in February. Loads available, though, have been weak compared to the five-year average. This past week, "total load activity ticked up 1% after the prior week’s 13.3% drop. Volume was nearly 60% below the same week last year and nearly 21% below the five-year average."

As noted in the weekly report, rates have been falling overall since the holiday surge in December, though "the declines have tracked with seasonal expectations." Broker-posted rates in dry van and refrigerated, though, remain relatively close to the five-year average, FTR/Truckstop said. The strength of spot rates will become clearer over the next several weeks as they typically begin to firm in February. Loads available, though, have been weak compared to the five-year average. This past week, "total load activity ticked up 1% after the prior week’s 13.3% drop. Volume was nearly 60% below the same week last year and nearly 21% below the five-year average."

The rates situation has declined such that there's ripe opportunity for scams featuring too-good-to-be-true rates that everyone should be on the lookout for. Just this morning, I spoke with an owner-operator marooned in the Texas ice storm chasing payment on a $2,500 load he booked with what, in retrospect, is looking like a classic brokerage identity-theft case -- the flatbed load was moved at an offered rate of around $6.70/mile.

[Related: What can you do when a freight broker doesn't pay?]

Unfortunately, the rate appears to have been a fraud, and the owner-op who moved the load is left holding the bag with little hope for actually getting paid that rate. Both the actual broker on the load as well as the owner-op here seem to have gotten in the middle of a double-brokering scheme, likely involving identity theft to cover tracks.

Contacting the shipper, the owner-operator tracked down what appeared to be the original offer on the load from the actual broker, and the rate was more in line with "market"/average rates, just north of $2/mile. Despite just about hitting the average, that's nowhere near what's desirable for the owner I spoke to, of course, and all the more evidence of the pernicious effect of freight-market fraud to push down rates -- in recent months, he's been getting closer to $4/mile all-in, and with this recent hit feels just like he's digging a deeper and deeper hole.

Before you jump headfirst into what might be an unrealistic rate, be sure you're doing all due diligence on the parties you're dealing with -- watch for email addresses coming from slightly different domains than who the fraudster claims to be representing, for instance, gmail addresses crafted to resemble the name of a real company, and etc. (The former was at play in the case here.)

And as I've written before, of course, identity-theft cases like this tend to get the attention of the folks at the Department of Transportation Office of Inspector General. For a bit of refresher on avenues to report them, read this story from last Fall. If you see the crooks using the load boards this way, report it to the board directly, too.

[Related: FMCSA/DOT getting serious about double-brokering?]

With so much fraud in the marketplace, what else can an owner-operator to do to ensure everything's on the up and up? I know our January Trucker of the Month Kelvin Schmidt would have one answer to that question: consistency, simply put, with a single customer he knows well, where he's a dedicated power-only carrier. Long-term, take the time to know just who it is you're dealing with, as small carrier/broker Jon Asiala urged everyone last fall after being taken by one of these identity thieves. Asiala, interestingly, sent me a note a couple weeks ago in which he speculated that, "in unison, it seems like the double brokers of the world took a couple weeks off, but they are back at it at full strength," judging by the calls he was getting on loads he posted on the boards.

He noted these characteristics:

Phone numbers vary quite a bit, but then again, what can you tell from VOIP number anyway?

States they are registered in [as carriers in this case] vary greatly as well. A year ago, 99% seemed like they were registered in California. Now their MC numbers are registered all over the place.

The number of trucks that are listed in the Safer website used to always show 1 or 2, but now they’re claiming to have more trucks like 6 or 8 or more...

They all seem to be on the same page with their responses to questions like:

- How long have you been in business? Currently the answer is usually 5 to 7 months.

- Why aren’t you listed in the DAT Directory? “We’re borrowing my cousin’s until we get ours set up.

Their preparedness hasn't really gotten any better. When asked “Where will your truck be tomorrow?” Some (ab)normal responses are:

- “What?”

- “In the morning”

- “We can pick up on time”

- “35 miles from the shipper.” They are just recently figuring out they should come up with a city name close to the shipper.

[Related: Axe double-brokering schemes: Know your broker/carrier]

While Asiala is talking about double brokers posing as carriers here, the same "if it doesn't sound right it probably isn't" sort of sentiment no doubt applies to owner-ops talking to those would-be scamsters posing as legit brokers, whatever the case. Asiala did note that it seems like for every load he posts on the board, using DAT in his case, "I usually get a minimum of one call from a 'double broker' and sometimes up to three. I get about the same number of calls from real carriers but my outgoing calls have gone up." He's been covering more loads based on "trucks being posted on DAT," then taking his own load post down. "I feel more comfortable with the trucks that I call on that are posted on DAT, but still have to vet them as well. The whole thing is still larger than I can comprehend at this point."

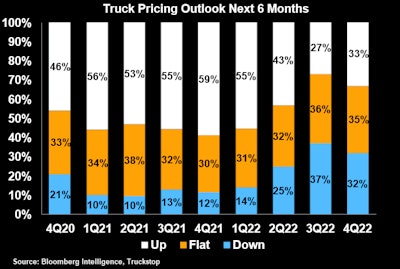

Despite all this, and a clear decline in expectations among Overdrive readers looking ahead to 2023, there's at least some optimism out there looking ahead to the next six months, according to that Bloomberg | Truckstop.com survey:

About 33% of owner-operator respondents expect rates to rise in the next six months, as shown in Q4 results above. An almost equal number, though, expected them to fall, and sentiment is generally split along similar lines as regards freight volumes.

About 33% of owner-operator respondents expect rates to rise in the next six months, as shown in Q4 results above. An almost equal number, though, expected them to fall, and sentiment is generally split along similar lines as regards freight volumes.

[Related: Fight double-brokering fraud: Attorney Hank Seaton on prevention, ways to elevate enforcement]