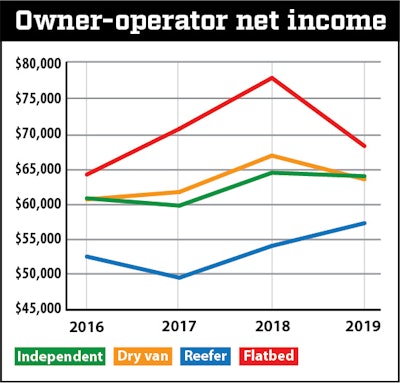

Earnings for flatbed haulers dropped more than 12% last year, while reefer haulers experienced a two-year gain of almost $7,800. ATBS forecasts owner-operators will need to run more miles in 2020 to keep up with an anemic market.

Earnings for flatbed haulers dropped more than 12% last year, while reefer haulers experienced a two-year gain of almost $7,800. ATBS forecasts owner-operators will need to run more miles in 2020 to keep up with an anemic market.Owner-operators’ net income dropped 3.6% last year to $62,992, reports ATBS, a financial services provider that serves thousands of mostly leased owner-operators.

It was a decent showing, given the year’s slower freight market and the difficulty of maintaining the fevered pitch of 2018. The drop of $2,368 was “not as much as it could have been in a tough year,” says Todd Amen, president of ATBS.

Both years saw average income among leased and independent operators above the 2017 average of ATBS clients, $60,182.

Flatbedders suffered the worst from 2018 to 2019, seeing income fall by almost $10,000, or 12.5%. Still, with 2019 income of $68,015, the segment was well ahead of dry van, reefer and the three-segment average of independents. “Flatbed has much higher highs and lower lows cyclically, so seeing flatbed fall off would lead me to believe overall things are slowing down,” Amen says. As economic indicators, flatbedders “lead us into good times and lead us out of good times.”

The year was kind to reefer haulers. Their earnings still trail dry van and flatbed, but they’ve narrowed that gap, rising from $49,267 in 2017 to $57,032 in 2019.

“Miles were at their lowest on record – 100,000,” Amen says. That reflected both the cooling economy and long-term trends for stronger pay and shorter lengths of haul. “As income started to decrease more in the 2nd half of 2019, drivers started running more miles, which they’ll do this year as well.”

Amid mostly falling rates in 2019, the flatbed segment still leads among major hauling niches.

Amid mostly falling rates in 2019, the flatbed segment still leads among major hauling niches.The net income of independents (averaging dry van, reefer and flatbed) dropped less than 1% in 2019, which isn’t bad considering the rise in liability insurance costs. “The true independent contractor under their own authority is getting killed in this area,” Amen says. Policies that cost $3,000 to $5,000 in 2016 or 2017 now often range from $12,000 to $25,000, he says.

This year “owner-operators will run more miles as the market and rates continue to be a challenge,” Amen says. They should pay closer attention to fuel and other costs and not “be too picky on rates or lanes.” Operators should manage more for the current mediocre rates and the downside risks posed by “coronavirus, Middle East tensions and recessionary freight. The upside will take care of itself.”

Amen invites owner-operators to register for a free ATBS conference call regarding these and other data, including a 2020 forecast. It will be 12-1 p.m. EST March 6.