Most owner-operators leased to larger carriers are paid on a per-mile basis or a percentage of revenue per load. The per-mile basis is traditionally most prevalent among larger fleets, percentage at smaller, though trends in recent history have seen percentage-based systems rise in prominence all around trucking.

Nonetheless, pay per mile can seem like it dominates discussions about compensation, because it is easier to measure, and it's often been wrongly used as the sole deciding factor in leasing to a carrier.

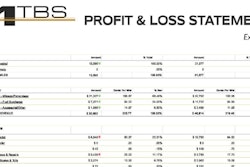

While the pay per mile figure can be a vital factor, it’s not a cure for every ill. Nor does it mean a big settlement check is coming your way. Why? Because pay per mile, or the percentage you're paid for the load, always must be considered in balance with gross revenue overall. Gross revenue is the total amount paid to you by a carrier. It can include flat mileage pay, mileage pay that varies by length of haul, percentage of revenue pay, loading/unloading pay, detention pay, stop in transit pay, fuel surcharge, toll or scale reimbursements, and etc.

To illustrate the potential differences, note the following hypothetical example, Carrier 1 pays $1.50/mile and pays the owner-operator a fuel surcharge and for unloading. Carrier 2 pays 70% of the revenue of the load, but no other expenses.

Which carrier would you choose to lease to?

It might appear before doing the calculations that you 're better off driving for the company that pays a percent of revenue. $2,800 in the load in total is a big number, and might sound great at first glance. However, after figuring your percent of revenue compensation, likewise all the accessorials coming your way on the miles-pay carrier's side, you bring in more than $100 less, or 12 cents less per mile, with the percentage carrier.

This is just one example, and doesn’t mean miles-based compensation always is better. Rather, it illustrates how pay can differ among carriers. Too often, operators overlook the importance of gross revenue. Some will change carriers for an extra 1 cent per mile, sacrificing $10,000 of annual gross revenue by making the change because they failed to realize the impact of the previous carrier's accessorials on gross revenue.

By focusing on just one element of revenue, fundamentally, you can miss the big picture.

Pay per mile, unless your carrier offers bonus mileage pay for shorter hauls or other variations, usually is consistent from month to month and year to year. Gross revenue is far less consistent, and any changes can have a disastrous effect on your fortunes as an owner-operator. Variables affecting gross revenue are many. They include weather and traffic, national and local economies, seasonal factors in niches like fresh produce hauling, changes to aspects of your company such as its sales and marketing personnel and customer base, communications, lanes of operation, competition, regulations and length of haul.

While you have no control over many of these, there are some ways you can help manage gross revenue:

Determine a reasonable number of miles you expect to run. This requires careful consideration of factors such as your age, experience, motivation, financial goals, health, personal and family needs, and the condition of your tractor or trailer, and may include estimates of average length of haul. Once you have established a reasonable number of miles to run each week, month and year, you have goals to work toward.

Measure your results frequently. Does your performance match your capacity? Does it match your goal? If it doesn’t, find out why and how to correct it.

Manage your time. You are your own boss and in control of how you use your time. The time you spend driving and delivering loads determines how much you get paid. Managing that time effectively will be key to your success.

Establishing a relationship and improve communication with your fleet manager/dispatcher. Trust is essential to success and is achieved through on-time pickup and delivery as well as good communication.

Common misconceptions about revenue

Most owner-operators have fundamentally greater control over costs than revenue, the money incoming, yet it’s also true that better understanding the relationship between both can yield dividends. That’s particularly true for independents with authority when the customer relationship is such that the customer is fully engaged in cost and revenue impacts you’re experiencing as an owner-operator.

If you know the costs of your operation, it’s important to stand your ground on rates that you know you need to be profitable. Case in point: In a time of sky-high costs and falling demand in all manner of freight markets, the summer of 2022, an independent was approached by his main customer, who was looking to cut rates by 7%. He put together a well-thought-out response detailing his quality work for the company through the years, and explained in detail how higher costs were impacting his business, with his own business-performance calculations to prove it.

The response he got allowed him to continue his current contract without taking the 7% cut, while also acknowledging exemplary service he provided the company.

[Related: Holding the line: Owner-operator's playbook to push back on cheap freight]

All the same, be aware of common revenue myths. Failure to do so can handicap your business.

MYTH 1 -- Concentrate only on increasing revenue because costs will take care of themselves. After reaching your break-even point, only a fraction of every extra dollar of revenue goes into your pocketbook, while 100% of every extra dollar saved stays in your pocket.

MYTH 2 -- More revenue per mile is the answer to all problems. As a leased owner, revenue per mile doesn’t change much from company to company, but there can be a big difference in miles, gross revenue, reimbursements and fees.

MYTH 3 -- All you have to do to be successful is run hard and get a lot of miles. Revenue is only half of the profit equation; costs are the other half. It’s possible to generate a lot of revenue yet spend $1.10 to make every dollar. Furthermore, in percentage of revenue pay programs with self-dispatch options for experienced operators, like running entirely independent with your carrier authority, choosing loads to maximize revenue on the shortest number of miles is the best strategy to long-term financial success.

MYTH 4 -- You can tell how well you’re doing by the size of your settlement check. The settlement check is only a small part of the success picture. Miles driven, loads hauled, weather and traffic conditions, mechanical problems, time off and, especially, costs all have to be considered.

MYTH 5 -- Your company can control how much it pays you per mile. Your company has limited influence on the rates it charges shippers because it is largely the marketplace that dictates rates.

Read next: Bookkeeping: Among the most important tasks for owner-operators to master