Trucking news and briefs for Wednesday, Jan. 19, 2022:

Florida-based fleet shut down by FMCSA, who cited ‘egregious’ safety violations

A West Palm Beach, Florida-based trucking company has been effectively shut down by the Federal Motor Carrier Safety Administration following a fatal crash and subsequent safety investigation. Professional Marine Hauler’s LLC was served a federal Imminent Hazard Operations Out-of-Service Order on Jan. 14.

On Nov. 9, 2021, the two-truck fleet was involved in a crash resulting in two deaths and nine injuries. FMCSA’s subsequent investigation found “egregious levels of non-compliance and a complete failure of the carrier and its owners to implement any aspect of a safety management plan,” FMCSA said in a press release.

The agency said the failure resulted in the fatal crash, which was caused by a complete trailer brake system failure.

“The agency’s compliance investigation found Professional Marine Hauler’s and its principals, Claudia Angelique Abreu and Ariel Martinez, operating CMVs with a total disregard for safety,” FMCSA added. “A pattern of non-compliance was noted in the operation of several motor carriers operated by the carrier principals, including violations documented during roadside inspections and failed new entrant safety audits.”

According to FMCSA, Abreu and Martinez continued to operate equipment after it had been placed out-of-service.

Attempts to contact Professional Marine Hauler's LLC went unanswered as of midday January 19.

According to FMCSA, the two company principals showed a total disregard for vehicle maintenance, driver qualifications, controlled substances and alcohol testing, hours of service and oversize/overweight limits for CMVs.

Other companies the Abreu and Martinez were connected with also affected by the order, FMCSA said, include A&M Marina Service Corp., A&W Tow & Transport Inc., Los Guerreros C Towing, and Jam Transportation Towing and Moving Corp.

Fuel prices continue recent surge

Diesel prices across the United States jumped another 6.8 cents during the most recent week, rising to just a penny shy of the 2021 high seen in mid-November, according to the Department of Energy’s weekly update.

Following the increase, the nation’s average price for a gallon of on-highway diesel is now $3.725. This week's average is the highest since the week ending Nov. 15, 2021, when prices hit $3.734 per gallon – the high mark of 2021 -- and effectively wiped out modest declines in diesel prices seen through December.

Prices increase in all regions across the country, with the most significant increase being seen in the Midwest, where prices jumped 8.1 cents.

The nation’s most expensive diesel remains in California at $4.789 per gallon, followed by the West Coast less California at $4.067 per gallon.

The cheapest fuel can be found in the Gulf Coast region at $3.463 per gallon, followed by Midwest at $3.603 per gallon.

Prices in other regions, according to DOE, are:

- New England – $3.698

- Central Atlantic – $3.877

- Lower Atlantic – $3.624

- Rocky Mountain – $3.678

ProMiles’ numbers during the same week saw fuel prices increase by 4.1 cents, bringing its national average to $3.551 per gallon.

According to ProMiles’ Fuel Surcharge Index, the most expensive diesel can be found in California at $4.685 per gallon, and the cheapest can be found in the Gulf Coast region at $3.357 per gallon.

[Related: Owner-Operator of the Year Bryan Smith at the very top of his game despite cost inflation pressures]

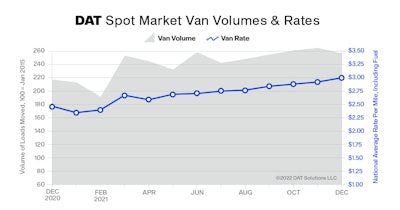

Rates close-out on 2021: Dry van, reefer at new record highs | Van and refrigerated (“reefer”) truckload freight rates hit new highs in December, with national average prices up 21.9% and 29.5% respectively compared to the same period a year ago, said DAT Freight & Analytics, which operates the DAT marketplace for spot truckload freight and the DAT iQ data analytics service. It was the seventh consecutive month for rates increases, the average van rate reaching $3 per mile for the first time in history. After increasing 17 cents month over month in November, the average spot reefer rate rose 2 cents to $3.47 a mile in December. The spot reefer rate has set a new high for six straight months and is 79 cents higher compared to the same period last year. The national average rate for flatbed loads on the spot market increased 2 cents to $3.08 per mile, a 59-cent gain year over year. DAT’s Truckload Volume Index (TVI) sat at 236, a 3% decline compared to November, when the Index set a record for the number of loads moved by motor carriers in a month. The TVI was up 18% year over year, though, reflecting strong truckload freight volumes as 2021 came to a close.

Rates close-out on 2021: Dry van, reefer at new record highs | Van and refrigerated (“reefer”) truckload freight rates hit new highs in December, with national average prices up 21.9% and 29.5% respectively compared to the same period a year ago, said DAT Freight & Analytics, which operates the DAT marketplace for spot truckload freight and the DAT iQ data analytics service. It was the seventh consecutive month for rates increases, the average van rate reaching $3 per mile for the first time in history. After increasing 17 cents month over month in November, the average spot reefer rate rose 2 cents to $3.47 a mile in December. The spot reefer rate has set a new high for six straight months and is 79 cents higher compared to the same period last year. The national average rate for flatbed loads on the spot market increased 2 cents to $3.08 per mile, a 59-cent gain year over year. DAT’s Truckload Volume Index (TVI) sat at 236, a 3% decline compared to November, when the Index set a record for the number of loads moved by motor carriers in a month. The TVI was up 18% year over year, though, reflecting strong truckload freight volumes as 2021 came to a close.