Find Part 1 in this series on the so-called “Uberization of trucking” via this link. Access all of the component parts via the page at this link.

“uShip was ‘sharing economy’ before that term even existed,” said Matt Chasen, uShip chief executive officer, in an interview last year (portions of it ran with our feature package of stories on hotshot trucking), invoking the old “peer-to-peer network” terminology. “To this day, we have a significant amount of our business that is average people that are taking road trips in small trucks that connect with people that need to ship things through a noncommercial sort of operation” – things that “otherwise there’s no way to move at reasonable cost.”

But with the rise in mobile technology, Chasen called uShip.com’s reverse-auction format “more or less dying or dead.” The reason: Transactional friction. All the time and effort spent bidding for transporters and receiving bids for shippers was too much.

Today, updates have been made. The company’s LTL marketplace is offering individual shippers access to instant rates on file from major LTL truckers. And in various other categories in the uShip universe, shippers are seeing options for algorithmic pricing based on historic rates in certain uShip lanes. In that structure, if transporters do not accept a shipper’s initial offer, the price then begins to creep up until someone does.

Carriers are seeing pressure from the system to activate an option for location sharing. This gives shippers visibility into the uShip mobile app’s users’ approximate location in transit and also can serve a marketing purpose in broadcasting availability to match with nearby loads. Soon, carriers that don’t enable location sharing will find use of the primary uShip.com platform limited in some ways.

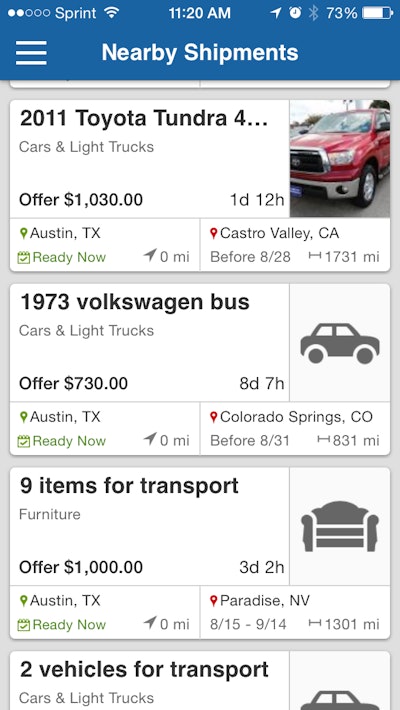

Nearby shipments search functionality and the instant-booking feature of the uShip mobile app further automates freight selection in some categories in the platform’s load universe.

Nearby shipments search functionality and the instant-booking feature of the uShip mobile app further automates freight selection in some categories in the platform’s load universe.Chasen envisions tomorrow’s trucker as what he calls the “little LTL” – an independent who uses such on-demand platforms to “help them maximize utilization of the asset” with a multiplicity of side opportunities.

Given the mix of professional interstate haulers and noncommercial drivers on uShip that Chasen mentions above, Overdrive readers have worried over the years that such “sharing economy” platforms open the door to entities unqualified to engage in interstate hauling. Such competition for freight puts those for whom compliance is a business expense at a disadvantage, with the potential then to depress rates in related markets.

While it’s no secret many qualified carriers have found freight-matching utility from the uShip system, those worries were foregrounded during the reporting of this story.

During routine fact-checking of an early March interview with a Texas-based hotshot owner-operator about then-ongoing use of the uShip.com freight marketplace to load his interstate business, the Federal Motor Carrier Safety Administration confirmed the owner-operator’s authority officially was inactive.

The business, officials said, had been placed out of service more than a year ago, following failure to complete a New Entrant audit, in February 2014.

While uShip.com offers SaferWatch verification of authority as a service to carriers to prove compliance to individual shippers and strengthen their business profiles in the system, it does not require it for those loading through the system.

NEXT: Where it’s on the way: ‘Uberization’ in long-haul truckload