Readers responded strongly to Overdrive George & Wendy Show blogger Wendy Parker’s “‘Cheap diesel’ makes my eye twitch” post about the sometimes infuriating back-and-forth between brokers and truckers in the declining-fuel-price environment of the past several months. “Wendy for President!,” crowed a commenter posting only as “Cletus,” and owner-operator William McKelvie urged fellow haulers to “stop being your broker’s friend.

“If we stop hauling all the stuff that is below published and recorded rates, all of it has to come up. … We are here for business, not selling yourself short to keep an account. There will be someone else who comes in and cuts that rate. They never stay, they never last.”

Overdrive publishes an at least monthly rates report based on Truckstop.com (Internet Truckstop) paid-rate averages for van, flatbed and reefer segments, which McKelvie added should be considered as such, an average, something more operators should at the very least make an effort to beat on rates if at all possible. Here’s the most recent such report.

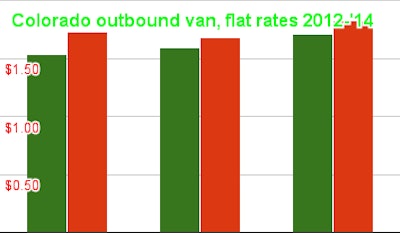

The fact that the central anecdote in Parker’s story involved rates out of the state of Colorado caught my eye, given that I’ve been in the weeds of a feature looking at average rates around the country over the past few years. For all segments, the average rate on loads outbound from the state of Colorado has been among the bottom 10 lowest rates among all states 2012-14. Here’s Those three years for Van (green) and Flat out of Colorado:

Reefer wasn’t much better, even in 2014, a comparably good year for rates in all segments in most areas. Colorado in 2014 for reefer: $2.04. 2013: $1.84. 2012: $1.80. The average-rate data in this case comes from rates reported to Truckstop.com on loads booked via the board.

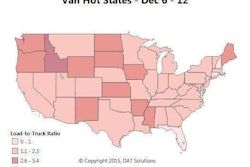

Following find the bottom states for rates on outbound van, flat and reefer loads on average for 2014. Talking with van owner-operator Chad Boblett this morning, the Kentucky-based sometime owner-operator dispatcher made note of the appearance of a couple of these same van states on the inbound-loads top ten list for, in fact, high rates — chiefly the Northeast states of Connecticut and New Hampshire. Colorado’s on that list, too.

It illustrates the double-edged sword that working the averages can be. At once, says Boblett, “if you don’t mind running the Northeast, you could easily go there and stay up there doing 150-, 300-mile runs, and you’ll make killer money – there are good-paying loads in the Northeast.” Top regional states for inbound van not on the outbound-low list are New York, Maryland, Maine and Delaware.

Every load is different, ultimately, though, and local supply/demand and niche commodity considerations always come into play as well. Nonetheless, how about a bit of a drumroll, please, for the rate-states “hall of shame,” if you will. Stay tuned for more on these subjects in the next month.

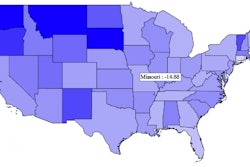

VAN outbound average rates for 2014, 10 lowest states

The same for FLATBED

And REEFER

A couple more voices on rates, via this post:

“A few years ago, I was a leased independent contractor. I would go into the Northeast, then the load planners would try to bring me out on loads paying less than that, with not-cheap fuel, and for flatbed work. I said nope, I live in Pennsylvania. I’ll just go home empty if that’s the best you can do. While I was deadheading I would get called with something more reasonable.” –Craig Vecellio

“You have to tell the brokers not every trip is a back haul and ask them if they would do their business for a loss. Before I haul to Denver, I make sure I have something out at a rate of better than $2-$2.50. If the brokers want to get paid better, then they need to get realistic. At once, there are so many brokers they are undercutting themselves and in turn creating a seemingly low-cost rate for the shippers.” –commenter posting as Jim

UPDATE 4/9/15: Digging further into Truckstop.com’s rate-average datasets, the metrics above were slightly revised based on the company’s “paid-rate” set, which consists of verified rates on loads booked on the board. The prior set used is, says Truckstop.com head Scott Moscrip, more reflective of broker offer rates, though it does contain a sizable quantity of carrier reported rates. Results: most of the same states/jurisdictions are reflected in the bottom-rung rates charted here.