The Truckstop.com live data feed as of 3 p.m. CDT April 16, 2015.

The Truckstop.com live data feed as of 3 p.m. CDT April 16, 2015.“The transportation industry is kind of like the Middle East, there’s always turmoil.” –Truckstop.com President and CEO Scott Moscrip

Moscrip was talking rates when he said that, and more specifically the constantly changing nature of the spot market where brokers and carriers position themselves for satisfactory profit margins. More particularly, too, he was talking about just why the company even bothers to attempt to track average broker offers and carrier paid rates, adding that it’s an attempt at least to reduce that turmoil and to bring all parties in the transaction a little closer together in terms of expectation. “The closer we get to helping both sides know what the [rates] expectation is, the better it is all around,” Moscrip added.

That also happens to be a goal of the (in various ways) Uber-like services I wrote about as part of the feature package on on-demand load matching or the “Uberization of trucking” that wrapped up last week.

While Truckstop.com was certainly a part of that story, given the turn in its focus to mobile and to working at speeding up the freight transaction from the load board for carriers, Moscrip calls all the hoopla around “Uberization” … “one of my least-favorite topics in transportation right now.

“We’ve been around long enough to have lived through the dot-com craze that went through 1999-2000. We were five years old, we’d seen some stuff come and go, but what happened was people got it in their mind that websites like pets.com or trucking.com would be the be-all end-all [of any given industry or space]. They took a lot of money, and they spent a lot of money and they didn’t really deliver a product. This is the axe I grind with the ‘Uberization’ focus – [the notion that] if I can just stick the word Uber on something it’s gotta be worth $30 billion.

“Uber is the latest buzzword because [the company of the same name] got this ridiculous valuation for something that has potential, but it’s a matter of finding the balance in it that really doesn’t exist currently in marketplaces. For example, the city of Boise and Uber were getting into it. In Boise they license the taxis and the city gets money off of that.”

With Uber coming in and avoiding the license fees, the “government didn’t like that,” Moscrip says. “They wanted the money. Within transport, though, the idea that you can take the number of trucks sitting in an area that are not busy and through some formula you’re going to dictate the price – in long-haul truckload, I don’t see that playing out. Short-haul/local – I can see that playing out.”

But to reiterate, not in long-haul. Imagining an owner-operator in such a scheme, Moscrip says, “the ability to optimize what he’s doing [ahead of time] totally falls apart. We won’t see the ‘Uberization’ of long-haul trucking.”

What is going to be seen, however, will be elements of the model. “We are going to see increased negotiation speed,” he says (referencing Truckstop.com’s new chat negotiations feature), “greater visibility of the capacity that’s out there, advance planning by people coming into an area. I think we’ll see all of that come into play, but unless we get a mass increase in our capacity, where we constantly have 8-10 percent of capacity idle,” automated rates and other elements of the Uber formula will not translate to truckload.

How it will happen: Moscrip points to Freightliner’s SuperTruck concept vehicle. “They’ve realized, ‘we might not be able to deliver this whole thing today, but pieces of it we can integrate seamlessly to get closer as time goes on,'” he says. The “same thing is happening in other technology. There’s a definite pile of venture capital flowing into transportation technology. We’ll continue to see the little dot-com things. And for us, this is an incredibly exciting time. The fourth iteration [of Truckstop.com] is revolutionary compared to the last 19 years. It’s an absolutely great time to be here now. If you’re not making money you need a few pointers to help you out.”

“The guys you see saying, ‘Don’t haul cheap freight’ —they’re right. There’s plenty of profitable freight out there to move right now, you’ve just got to find it.” –Scott Moscrip

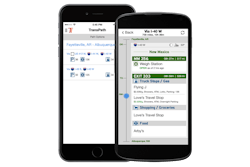

The board updated last year with new tools for carriers, says Brent Hutto, Truckstop.com marketing director. “We transitioned our system to be able to display as much info as we have about a load much more specifically” and in one place in the web application, depending on the carrier’s subscription level. Included in that would be “the quality of the broker to [average lane paid and posted rates] to the number of outbound loads in an area,” that whole set of factors that can be figured in to what it will take to get it from point A to point B. “To know all that, and take a whole snapshot of that, is very powerful. That enables you as a carrier to have a clear picture about the value of the load” before you ever communicate with a broker.