Several years ago, I stumbled upon the subject of behavioral economics when I made an online search for the phrase what was I thinking? Behavioral economics is the study of our financial decision-making processes. What’s caught my eye reading more about it is the high degree of irrational behaviors we all are guilty of. With the influence of social media, it’s getting more and more prevalent — about any day of the week you can experience a social-media dumpster fire and its pernicious influence.

“There are many examples to show that people will work more for a cause than for cash.” ―Dan Ariely in his Predictably Irrational book; read an intro via this link

In the last couple of weeks, the subjects of high freight rates (one broker was quoted recently calling it carrier “price gouging”), as well as concurrent predictions of a freight-rate crash, have saturated internet groups.

I posed questions related to these subjects in an owner-operator mentoring group I engage routinely. I wanted to know if people could articulate how they selected their loads, and if they thought we were at risk of “price gouging” our customers.

Most of these owner-operators don’t believe it’s even possible to “price gouge” during a rate negotiation. This may be true if both parties have the right of refusal. The caveat in the responses is that every single person noted they were much less likely to try to pursue an exorbitantly high price when dealing with a customer/broker they’ve dealt with positively in the past.

Most, too, suggested they were as concerned with repeat-business consistency as with rates.

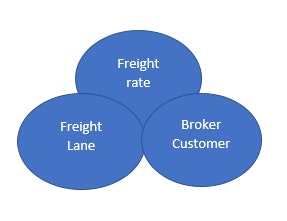

Attention to lanes/areas of operation figured into load-selection parameters as much as customer relationships and freight rates.

Attention to lanes/areas of operation figured into load-selection parameters as much as customer relationships and freight rates.And when it comes to pricing, ultimately, there is an old saying: “One man’s ceiling is another’s floor.” Developing a consistent “pricing formula” may prove to be of great benefit to you.

Understand “price anchoring” to get yourself started. That’s basically a term to describe the development of preconceived ideas of what a normal price for something is. Many owner-operators believe the price per mile should equal the per-gallon cost of fuel. This is an example of price anchoring. Others say their goal is $1,000 gross for the day. Another example. But assuming profit springs eternal from an anchor price can be risky business.

Research shows us that a price anchor can be easily manipulated, and we may not recognize that manipulation when it happens. We have our price anchors, but our customers/brokers have ever-evolving price anchors, too. Where’s the ceiling and where’s the floor?

I went back to the original group and asked whether or not they knew their costs per mile. Some responded, but not many. My impression of the community at large in trucking is that far too many do not keep up with detailed bookkeeping, including cost per mile analysis. If you know your cost, you can easily assess whether a load is going to generate the amount of profit you need to pay yourself and then have a healthy 20 percent left over to bank in the business as profit. (If you’re not accounting for payment to yourself in your overall cost per mile, that margin needs to be more in the area of 40 percent, according to previous research.)

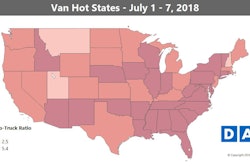

Once you establish an anchor, it begins influencing your freight rates and your buying habits. Back in December, I discussed rates with Overdrive’s Todd Dills, noting I had moved my own price anchor when considering loads to a $4/mile target from $3/mile. I continually adjust my pricing formula based on attainable profit, variable costs, day of the week or month, weather, freight lanes, weight, hazmat considerations, load assistance and the time needed to service the customer. On the load board I use, capacity-availability metrics in the wider market are available — I can watch total load counts and spot rates move up and down in near real time. Lately, the board has shown a 7-8 load-per-available-truck ratio, and other boards show similar metrics. My sources indicate those ratios are tracking nearly double of where they were 12-15 months ago.

When considering adjustments to my pricing, I take all of this information into consideration.

Where are freight rates going? As I said back in December, it looks as if it is still unpredictable. Some customers seem to be recognizing that capacity is going to remain tight and may be primed for a longer-term freight contract to try to avoid the spot market, where some apparently feel “price gouging” is happening.

This offers many of us the opportunities we want. Offer your best customer service, and don’t be afraid to ask the customer what they want in a service provider. Do you want to take the risk of only being the person to fill the spot bid, or the preferred business partner hauling hundreds of loads for your preferred customers?