When I began driving over the road in 1993 as a lease-purchase owner-operator, I often heard company drivers and media talking about the slow death of the owner-operator model in trucking. There was apparently just no room for “outlaw truckers” in the industry anymore. Nothing but uncouth, unwashed bums, drug addicts defiling what trucking could be. They talked about how drug testing was going to run them out of business, and stricter tax laws were not going to allow them to cheat on taxes anymore. They also talked about how larger companies were cutting rates so owner-ops could not afford to haul the freight.

Yet here we are 26 years later: trucking teems with owner-operators, drug testing proved to be beneficial in keeping everyone safe and weeding out the bad companies and drivers. Tax laws have done what they have always done — they’re more difficult to follow, and they seem designed to bleed everyone as dry as possible, no matter what your profession.

Not long ago our favorite state of confusion … I mean, California … passed the A.B. 5 law, which set off a flurry of speculation and uproar in trucking. It’s been a hard-fought but so far losing battle by associations and grassroots groups there, including the Western States Trucking Association and the California Trucking Association, both of whom feel A.B. 5 will be detrimental to the owner-operator model in a variety of ways. Rumors and reports have swirled that some companies have already instructed lease drivers to either move out of California or cancel their contracts. Of course there are proponents who feel the two-check model of days past could satisfy the new law and offer more opportunity for owner-operators. Or drivers leased to companies could simply get their own authority and work through brokers. For lease-purchase drivers the choices are not so good, and years of hard work and lease payments could be for nothing.

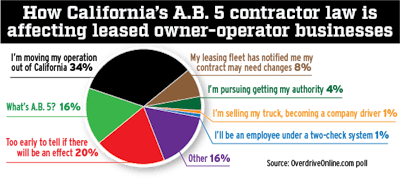

For owner-operators in Overdrive‘s audience, those A.B. 5 may have an effect on reported a range of possible disruptions to their business, reflected in the pie chart above based on poll responses collected last month.

For owner-operators in Overdrive‘s audience, those A.B. 5 may have an effect on reported a range of possible disruptions to their business, reflected in the pie chart above based on poll responses collected last month.The Owner-Operator Independent Drivers Association, strangely enough, seemed rather silent on the issue as it worked its way through the California system. Yet now that similar rules are working their way through New Jersey, they have found their voice and now seem to be joining the fight against it.

Still, the fuse is lit, and Congress is now debating the independent contractor model. Could this finally be the end of owner-operators?

I hope not. As a leased operator, I choose to be self-employed because I like being in control of my own destination. I enjoy the extra work and effort it takes to be a small-business owner. I also like knowing that my success is based upon my faith, my effort, my ability to learn, and my ability to adapt. I choose to be an owner-operator because when I feel it is time to go home, I do not want that control in the hands of another company employee who goes home every night. I choose to be an owner-operator because I make the decisions about equipment, and pace, and though I seldom turn down a load, I hold the opportunity to do just that if it makes no sense to take it.

Still, the main reason I choose to be an owner-operator is the opportunity to build something that I may one day leave for my children. The last thing I want, or need, is government stepping in and telling me just how I cannot do that. If I abide by the rules and stay safe in my operation and honest in my dealings, I do not need Big Brother dictating my destination. I would rather leave that to God and my effort. I am also quite aware that if you open the door a crack, Big Brother will kick it in and take advantage, and this simply boils down to one basic foundation. That’s freedom — to choose, to make mistakes, to learn and to lift myself and my family to a better financial level.

Are we in the death throes of the owner-operator model? Maybe the bigger question is are we willing to allow government to chip away at the very freedoms we so cherish and be a slave to those who pick up the pieces.