Previously in this series: How PPP loans, other pandemic measures, could affect owner-operators’ 2020 tax bills

Purchasing a truck by year-end or waiting until the new year could make a big difference in your tax bill for 2020 or 2021.

Purchasing a truck by year-end or waiting until the new year could make a big difference in your tax bill for 2020 or 2021.The standard year-end tax optimization regarding timing of expenditures and depreciation is certainly worth looking at following the economic roller-coaster of 2020. That ride’s left some owner-operators licking their wounds, others rolling in surprisingly high second-half net income, so one operator’s tax strategy might be the opposite of another’s.

There are updated limits and other changes for 2020, some covered here. Others were one-time matters tied to the pandemic’s blow to the economy and covered in Part 1 of this series Friday.

Thoughts on these matters of timing and miscellaneous other income tax points not already addressed are offered by Michael Schneider and David Campos of financial services provider ATBS, as well as a few other experts.

WHEN TO BUY. One year-end tax move always available to every owner-operator is the timing of equipment purchases. If deductions for the year are sparse and income is good, it can make sense to buy business equipment of any value by Dec. 31. If you’ve got plenty of depreciation and other deductions for the year, holding off until January might be best.

BONUS DEPRECIATION. The Internal Revenue Service still allows depreciating up to 100% of business purchases in one year instead of spreading them over three or four years. This holds through tax year 2022, then begins dropping 20% each year until expiring after 2026. As with timing of major purchases, get advice on how to schedule your trade cycle and depreciation so that you can lower taxable income when you need to and not “waste” deductions by accruing them in years when they’re not needed.

AVERAGING LOSSES. The IRS has reinstituted what it calls “net operating loss carryback,” an older provision that had been revoked in recent years. It’s a way of using bad years to reduce taxable income in very good years, starting by going back five years. If you have a loss that gets applied to, say, 2018 – a good year for many in trucking – you can amend that year’s return to get a refund or reduce what you owe in tax.

RETIREMENT SAVINGS. Funding an Individual Retirement Account or other tax-qualified plan is another way to reduce taxable income. The limit remains at $6,000 for individuals, $7,000 for those over 50 years old. Double those amounts for married taxpayers filing jointly. Contributions can be made up to April 15 (or Oct. 15, if you have to file for an extension) and be deductible for 2020 taxes.

If you incur expenses in establishing a retirement plan this year, they are deductible for 2020 even if the account isn’t funded until later.

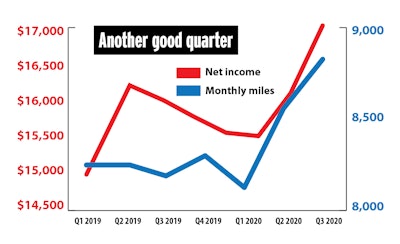

Despite the poor freight rates during the widespread COVID-inspired lockdowns of April and May, income for ATBS owner-operator clients rose considerably in this year’s second and third quarters. This could dictate certain tax-related moves by Dec. 31 for those leased and independent operators who’ll end the year with strong earnings.

Despite the poor freight rates during the widespread COVID-inspired lockdowns of April and May, income for ATBS owner-operator clients rose considerably in this year’s second and third quarters. This could dictate certain tax-related moves by Dec. 31 for those leased and independent operators who’ll end the year with strong earnings.BUSINESS STRUCTURE. ATBS’ average income for its owner-operator clients was $62,992 in 2019. Then during spring’s severe COVID-19 lockdown, rates plunged and many independents and larger carriers suffered.

However, leased operators and independents saw significant net income rebounds in the second and third quarters, putting many on track to exceed the 2019 average. If you see your annual net income approaching $65,000 and your business is structured as a sole proprietor, there could be a tax savings in converting to an S Corporation, Schneider said. Check with your accountant.

HIGHER STANDARD DEDUCTION. Since the tax code was changed a few years ago to boost the standard deduction for individuals and married couples, it’s made sense for most taxpayers (87% of filers for the 2018 tax year, says the IRS) to use the standard deduction instead of itemizing deductions for property taxes, charitable donations, etc. For 2020, the standard deduction rose $200 (to $12,400) for single filers and $400 (to $24,800) for married filing jointly.

A new provision allows reducing adjusted gross income by $300 for charitable deductions, even for taxpayers who don’t itemize deductions. Michael Schneider of ATBS warns that not all churches have the proper IRS categorization for tax-deductible donations.

A new provision allows reducing adjusted gross income by $300 for charitable deductions, even for taxpayers who don’t itemize deductions. Michael Schneider of ATBS warns that not all churches have the proper IRS categorization for tax-deductible donations.A SMALL BREAK FOR CHARITABLE GIVING. Even though most taxpayers won’t itemize deductions, thereby missing the federal tax advantage of charitable giving, the IRS now allows a $300 maximum per filing (individual or married) on donations that will reduce adjusted gross income. However, the recipient must be a 501(c)(3) organization. Annual contribution statements sent to donors should make that clear, Schneider said, but otherwise you can check a list of 501(c)(3) organizations on the IRS website.

HEALTH SAVINGS ACCOUNT. “If you have an HSA-qualified health insurance plan, one way to lower your taxes is to contribute the maximum allowed in your HSA,” said Matt Rosenberg, an accountant active with the American Institute of CPAs (AICPA). That max is “generally $3,550 for individual coverage or $7,100 for family, $1,000 additional catch-up contribution allowed if age 55 or older.”

Schneider notes those limits reflect slight raises for 2020 — $50 for individuals, $100 for families. HSA accounts are used with policies that have low premiums and high deductibles.

“In addition to providing a tax deduction, HSA dollars carry over indefinitely and are yours even if you switch jobs or retire,” Rosenberg said. “They can also be distributed without penalty once the account owner is on Medicare, so if you have the funds, it would be a shame to miss out on this tax savings opportunity while also saving for future health care costs.”

BALANCE INVESTMENT SWINGS. The pandemic initially caused extreme losses in certain stocks, good gains in a small number of others. However, the market rebound in the year’s second half has boosted many stocks across the board. If you have investments inside or outside of retirement accounts, there could be some smart stock portfolio moves to consider before year-end.

“Remember to coordinate your capital gain/loss harvesting strategy with your tax planning,” said accountant Oscar Vives Ortiz, who’s active with AICPA. “If you expect to be in a higher tax bracket next year, it may be better to carry the capital loss into next year to help offset capital gains in 2021 instead of incurring capital gains in 2020.”

NO PER DIEM BOOST. For the new fiscal year that began Oct. 1, the IRS is leaving the per diem rate at $66 per day, with 80% ($52.80) tax-deductible.

BITCOIN PLAYERS. New on the first page of every version of 1040 forms is a question asking if the taxpayer bought or sold cryptocurrency. “If you answer no, but you did, the IRS considers it criminal activity,” Schneider said. “We don’t know how serious they are about this.”