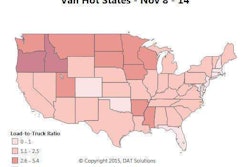

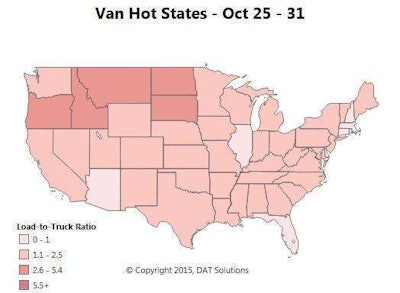

Spot market van load availability, after weeks of flat or declining numbers on DAT Load Boards, rose 8.4 percent last week, the company reports. Truck posts declined 2.2 percent, pushing the national load-to-truck ratio up from 1.3 to 1.5. For the month of October, load posts were down 11 percent compared to September, but demand remained high in the Pacific Northwest agricultural markets, as shown in this map. A relative shortage of trucks also led to higher ratios in the Dakotas and in Missoula, Mont., but demand there was more subdued.

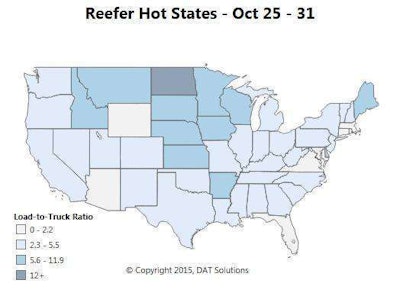

Spot market van load availability, after weeks of flat or declining numbers on DAT Load Boards, rose 8.4 percent last week, the company reports. Truck posts declined 2.2 percent, pushing the national load-to-truck ratio up from 1.3 to 1.5. For the month of October, load posts were down 11 percent compared to September, but demand remained high in the Pacific Northwest agricultural markets, as shown in this map. A relative shortage of trucks also led to higher ratios in the Dakotas and in Missoula, Mont., but demand there was more subdued. Reefer volume held steady last week, but the national average rate declined by 1 cent to $1.94 per mile, or steady since the last, Oct. 14 update. Compared to September, the load-to-truck ratio for reefers declined a marked 18 percent, though it represents a common seasonal trend. Reefer demand remains robust in agricultural markets of the Upper Midwest, including Green Bay, Wis., where outbound rates rose 10 cent last week to an average of $2.73 per mile.

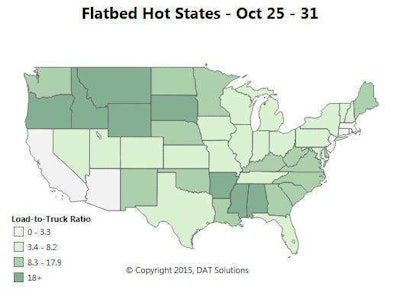

Reefer volume held steady last week, but the national average rate declined by 1 cent to $1.94 per mile, or steady since the last, Oct. 14 update. Compared to September, the load-to-truck ratio for reefers declined a marked 18 percent, though it represents a common seasonal trend. Reefer demand remains robust in agricultural markets of the Upper Midwest, including Green Bay, Wis., where outbound rates rose 10 cent last week to an average of $2.73 per mile. Spot market rates held steady for flatbeds last week, despite a 7.8 percent increase in capacity that drove the load-to-truck ratio down by a similar percentage to 8.5 loads per truck. That, DAT says, is an uncharacteristically low ratio for flatbeds for its boards, falling below 10 in October for the first time in three years. The national average rate slipped 3 cents lower in October compared to September, to a national average of $2.00 per mile, or 3 cents below levels a month ago in the last update. Outbound rates lost traction in Houston, a historically strong flatbed market, where rates were down 4 cents to an average of $2.05 per mile last week. Rates also declined in Atlanta, down 8 cents to $2.21, but outbound flatbeds got a 6-cent increase out of Los Angeles to $2.32 per mile.

Spot market rates held steady for flatbeds last week, despite a 7.8 percent increase in capacity that drove the load-to-truck ratio down by a similar percentage to 8.5 loads per truck. That, DAT says, is an uncharacteristically low ratio for flatbeds for its boards, falling below 10 in October for the first time in three years. The national average rate slipped 3 cents lower in October compared to September, to a national average of $2.00 per mile, or 3 cents below levels a month ago in the last update. Outbound rates lost traction in Houston, a historically strong flatbed market, where rates were down 4 cents to an average of $2.05 per mile last week. Rates also declined in Atlanta, down 8 cents to $2.21, but outbound flatbeds got a 6-cent increase out of Los Angeles to $2.32 per mile.