UPDATE, April 2, 2024: This story has been updated to reflect a dispute around who claimed FMCSA "raided" TQL's Ohio office.

FMCSA denied it "raided" TQL's office, but confirmed to Overdrive that it did force the broker to disclose the rate a shipper paid amid a raging battle between carriers and brokers in the down market.

So while nobody kicked in TQL's doors, one owner-operator succeeded in becoming the first-ever recorded case of forced broker transparency in trucking, and her story calls attention to longstanding animosities and a system in need of reform.

FMCSA 'raids' TQL?

Since late November, owner-operator Dakota Springfields, who now hauls intrastate in Florida as Pink Cheetah Express, has claimed victory over TQL after FMCSA "compelled," or perhaps visited the Ohio-based broker's office, forcing them into disclosing the rate a shipper paid TQL to move a reefer load back in January.

Springfields said that TQL fought her on paying two out of three accessorials on the load, which she says included multiple stops and a lumper. Furthermore, she said the company has since blacklisted her, and she is exploring suing them over potential breaches of anti-monoploy laws.

Springfields showed Overdrive an email from an FMCSA official that revealed "TQL received payment in the amount of $2,636.06" from the shipper. That comes out to a 44% take compared with what TQL paid her, she said.

Citing legal concerns over confidentiality, Springfields refused to show Overdrive a rate confirmation to prove she only saw 56% of the rate paid to TQL.

Overdrive reached out to TQL for comment on their interaction with FMCSA and Springfields.

A press release sent in late November by Springfields said that "FMCSA sent field agents into TQL's OH offices" and "seized, and then released previously requested transactional information on a January 2023 load of ice cream."

FMCSA disputes that entirely, breaking with its usual practice of not commenting on active investigations to provide "a response to correct widespread misstatements on social media regarding aggressive enforcement actions relating to a complaint" to the agency that came in via the National Consumer Complaint Database.

"In this particular case, the Agency received a complaint and conducted a virtual investigation, which did not involve an on-site visit, to review the claims raised by the complainant," an FMCSA representative told Overdrive. "The agency has received documents from the parties, and the investigation is ongoing."

FMCSA continued that it "takes broker fraud seriously and has initiated a rulemaking pertaining to broker transparency. We look forward to further work with stakeholders on this important issue during the formal rulemaking process."

That rulemaking process drew the ire of trucking's owner-operators when FMCSA delayed action until October 31 of 2024, but here again FMCSA confirms it's in process.

As for the FMCSA kicking down doors at TQL, that simply didn't happen, according to the agency. "FMCSA does not 'raid' offices of its regulated entities," it said.

[Related: FMCSA signals intent to move on broker transparency petition]

Pink Cheetah catches TQL in a lie?

Despite a lack of evidence and clarity around the rate and how it was ascertained, Springfields, along with other small trucking associations, used this evidence to say the 44% margin exposed "a lie" and "broker propaganda" from TQL and former TIA CEO Bob Voltmann, who in a 2020 video claimed that brokers generally see an average margin of around 16% on loads.

"Anything over 16% is just plain greed," she said. "Shippers are being duped into thinking 84% of a load goes to the carrier."

Springfields' release and media campaign echoes efforts of other associations like the National Owner Operators Association, which has called for a boycott of TQL over issues of nonpayment and lack of transparency since early this year.

Things got so heated that a NOOA member drove his truck and trailer to the TQL office in Ohio and demanded, successfully, payment in person after the broker "offset" its way out of paying him around $8,000.

[Related: TQL 'offsetting' its way out of paying carriers?]

But the revelation that TQL, allegedly, made 44% on a single load doesn't disprove Voltmann's claim three years ago that the average comes out to 16%.

DAT Chief of Analytics Ken Adamo said that one rate on one load simply doesn't mean much in the grand scheme of things. "There's loads where they make 100 percent," he offered, as well as plenty of loads where a broker loses money, too.

"The average broker margin in the industry goes up and down a little bit with the market, but it's anywhere between 13-18 percent," he said. "The distribution is pretty wide, with a lot of shipments where they might make 20 or more percent and a lot where they might make eight."

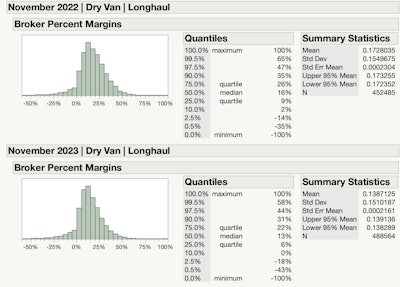

Adamo, briefly getting into it with some of the transparency advocates on Twitter, provided the following breakdown of DAT's numbers for November, clearly showing a median margin of just 13%.

Carriers don't just have to take Adamo's word for it. Publicly traded brokers like C.H. Robinson, J.B. Hunt, RXO and others all publish quarterly information on their margins for their shareholders. Any dishonesty there would be punishable by the Securities and Exchange Commission, and a disaster for the business.

Adamo said DAT's data comes from around 1,300 direct partners, customers that contribute data based on verified shipments that have been completed, not just posted on a load board.

"We publish observed market averages," he said. "We have for roughly 12 years."

As for those 44%, even 100% margins brokers sometimes manage, Adamo said that "what happens is these bigger brokers have a lot of set contracts with shippers. TQL might have a big contract with Walmart, for example, and they might have signed the contract a year ago when rates are really high. Now, it's the job of the capacity team to cover the load at market rates."

While it might be a tough pill to swallow that a broker could make 100% on a load without ever doing so much as a pre-trip inspection, remember that when the market moves in the trucker's favor, the shoe's on the other foot, and TQL and everyone else will be locked into contracts at low rates, likely losing money on loads.

"This is perfectly legal, it's not price gouging or anything," Adamo said.

It's not hard to find freight brokers bragging about the "fattest rips," or making obscene margins, sometimes above 100%, off the backs of truck drivers. But, generally speaking, the ironclad rules of supply and demand tend to even things out, and those outliers don't do much to move the average.

"It all washes out," generally speaking, said Adamo.

So what's left of Springfields' incendiary claims that can be proven? Not much. TQL got paid $2,636.06 to cover a load. FMCSA confirmed that with TQL. Springfields said that comes to 44%, but even if it does, that's not exactly news.

According to Adamo, the real shame here is that carriers are devoting time and resources to pursuing legal and practical dead ends.

"From what I can surmise with talking to my customers, there's a big legal question about whether you can actually make carriers waive that right" to broker transparency covered in 49 CFR 371.3, he said. That regulation ensures carriers can see the documentation around a load, including the rate paid to the broker.

"It's not a right" to transparency, he said, "it's a regulation. It's a ruling by the FMCSA, which makes rules. It's not legislation. It's a tricky gray legal area."

That's exactly why some carrier might one day take a broker that asks carriers to waive their ability to request transparency to court. Until a judge rules on this practice, it's just unclear how legal that is.

Also, imagine the administrative burden on brokers if they had to provide all the information on every load to every carrier every time, knowing that some shipper information may have to be redacted. And carriers could get documentation on every single load hauled, but what would they do with it?

The Owner-Operator Independent Drivers Association has asked for just that with its prior petition to FMCSA, asking for required, automatic broker disclosure of transaction records within 48 hours of completing a load. The rationale? The information could increase transparency and guide truckers' future decisions about doing business with that broker. FMCSA signaled intent to move on a possible regulation in response to that and other related petitions earlier this year. One from the Small Business in Transportation Coalition also sought to outlaw the practice of brokers requiring carriers to waive their access to transaction records under 49 CFR 371.3.

Adamo acknowledged inequalities in the broker/carrier relationship. "Brokers have access to more information than carriers," he said. But Adamo sees himself as trying to close that gap with good information for carriers in the form of DAT's analytics, and he welcomed the challenge from carriers.

"You have to scrutinize who you get info from," he said. "You have every right to ask about our credentials and ask follow ups and how the data is calculated. We want you to access data sources the best you can and help you make better decisions."

In the end, Springfields admitted that the FMCSA's findings weren't a smoking gun showing the entire broker industry lies about its margins, but stuck to her guns. "If TQL wants to say their margins are fair, let them give every driver the rate confirmations," she said. "We should not have to beg for it, they should have to give it."

In any case, Springfields did succeed in getting the FMCSA to contact TQL and make them provide rate transparency, something she said took months of hard work.

"I am working really hard and diligently," she said. "People thought I just wrote a letter, but I have been calling and emailing and pushing people to act. If they want to say the margin is 16%, then release everyone's confirmation and we'll be able to see."